Disney+, Tubi, Netflix and Max each exhibit double-digit monthly usage growth.

ABC, NBA Finals capture top five broadcast telecasts; CNN Presidential Debate tops cable.

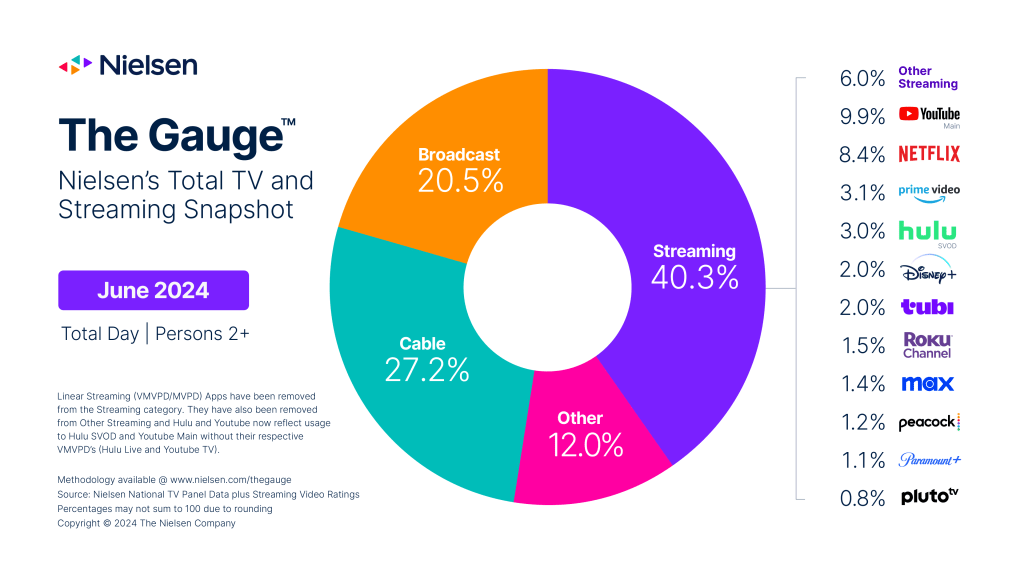

NEW YORK – July 16, 2024 – The month of June ushered in another blazing summer of streaming. According to Nielsen’s June 2024 report of The Gauge™, time spent streaming soared to 40.3% of total TV usage, topping the previous single category record set by cable in June 2021 (40.1%) and notching the highest share of TV ever reported in The Gauge.

Across streaming platforms, four notched double-digit usage growth including Disney+ (+14.8%), Tubi (+14.7%), Netflix (+11.8%) and Max (+11.0%), all with 20% or more attributable to younger viewers. Additionally, most streaming services exhibited shares that were near or equal to previous platform-bests, while YouTube and Tubi both set high watermarks with 9.9% and 2.0% of TV, respectively.

June also marks the end of the school year and beginning of summer break for most kids and teens, and the additional free time led viewers 17 and younger to exhibit the largest upticks in TV usage across age demographics. Younger audiences also helped drive a slight monthly increase in overall TV usage in June (+2.1%), which was also fairly flat compared with June 2023 (+1.3%).

Streaming viewership increased 6% compared with May and the category added 1.5 share points to finish June at a record-setting 40.3% of TV. As streaming makes up a larger share of younger viewers’ television time, the category received a disproportionate bump from the 2-17 age demographic, including a 16% increase in viewing from kids 2-11.

Netflix added almost a full share point in June (+0.8 pts.) and jumped to 8.4% of total TV, just a tenth of a share point below its platform best 8.5% which it set in July 2023. Netflix capitalized on considerable viewership from this month’s top two streaming titles: Its original series Bridgerton led the way with 9.3 billion viewing minutes, and Your Honor, Bryan Cranston’s Showtime and Paramount+ import, had the second highest total with 7.5 billion minutes across Netflix and Paramount+. High-profile content from other platforms also garnered notable viewership in June, including Prime Video’s original series The Boys whose new season helped drive 4 billion viewing minutes, and House of the Dragon, the HBO network series on Max, which totaled 3.4 billion minutes on the streamer.

Broadcast claimed 20.5% of total TV time in June, seeing some benefit from viewing increases of 26% in sports and 5% in news. This comes as a result of the top seven most watched broadcast telecasts this month—all of which aired on ABC—including the NBA Finals covering the top five, followed by ABC’s simulcast of CNN’s Presidential Debate, and Game 7 of the NHL Stanley Cup Finals. NBC’s Sunday night broadcast of the women’s gymnastics Olympic Trials settled into the 8th slot among top telecasts with 7.4 million viewers, foreshadowing one of the summer’s biggest TV events.

The cable category, which totaled 27.2% of TV usage in June, also saw big viewership numbers from the CNN Presidential Debate. The simulcasted debate claimed the top two cable telecasts of the month, with CNN leading the pack with over 10 million viewers, followed by Fox News Channel with 9.5 million. Cable’s ‘general drama’ and ‘feature film’ genres were each up about 6% from last month, but viewing in the cable sports genre declined 35% as both the NBA and NHL concluded their seasons with broadcast televised events.

It’s typical for traditional linear TV to exhibit a lull in viewership during the summer months, and both broadcast and cable recorded fairly sharp declines in their share of TV usage in June. The broadcast category lost 1.8 share points and cable fell by 1.0 point, bringing the two to a combined 47.7% of overall TV this month. The wildcard for traditional TV as we move into July and August will be the Summer Olympics, whose widely covered quadrennial events have historically drawn sizable audiences across both broadcast and cable networks.

The measurement interval for June 2024 was 05/27/2024 through 06/30/2024.

About The Gauge™

The Gauge™ is Nielsen’s monthly snapshot of total broadcast, cable and streaming consumption that occurs through a television screen, providing the industry with a holistic look at what audiences are watching. The Gauge was expanded in April 2024 to include The Media Distributor Gauge, which reflects total viewing by media distributor across these categories. Read more about The Gauge methodology and FAQs.

About Nielsen

Nielsen is a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviors across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their global audiences—now and into the future. Learn more at www.nielsen.com and connect with us on social media (X, LinkedIn, YouTube, Facebook and Instagram).

Press Contact

Lauren Pabst, Nielsen

[email protected]