- Auto sector invested $690m in ads during FY 2024

- Top 10 automotive ad spenders revealed

- Top 5 most advertised EV models

- Number of Aussies wanting an electric car up 4.2% YoY

Sydney, Australia – August 19, 2024 – Nielsen has released its most recent Ad Intel and Consumer and Media View (CMV) data on the automotive industry in Australia, showing an 8% year-on-year increase in ad spend for the sector, topping $690 million for FY 2024.

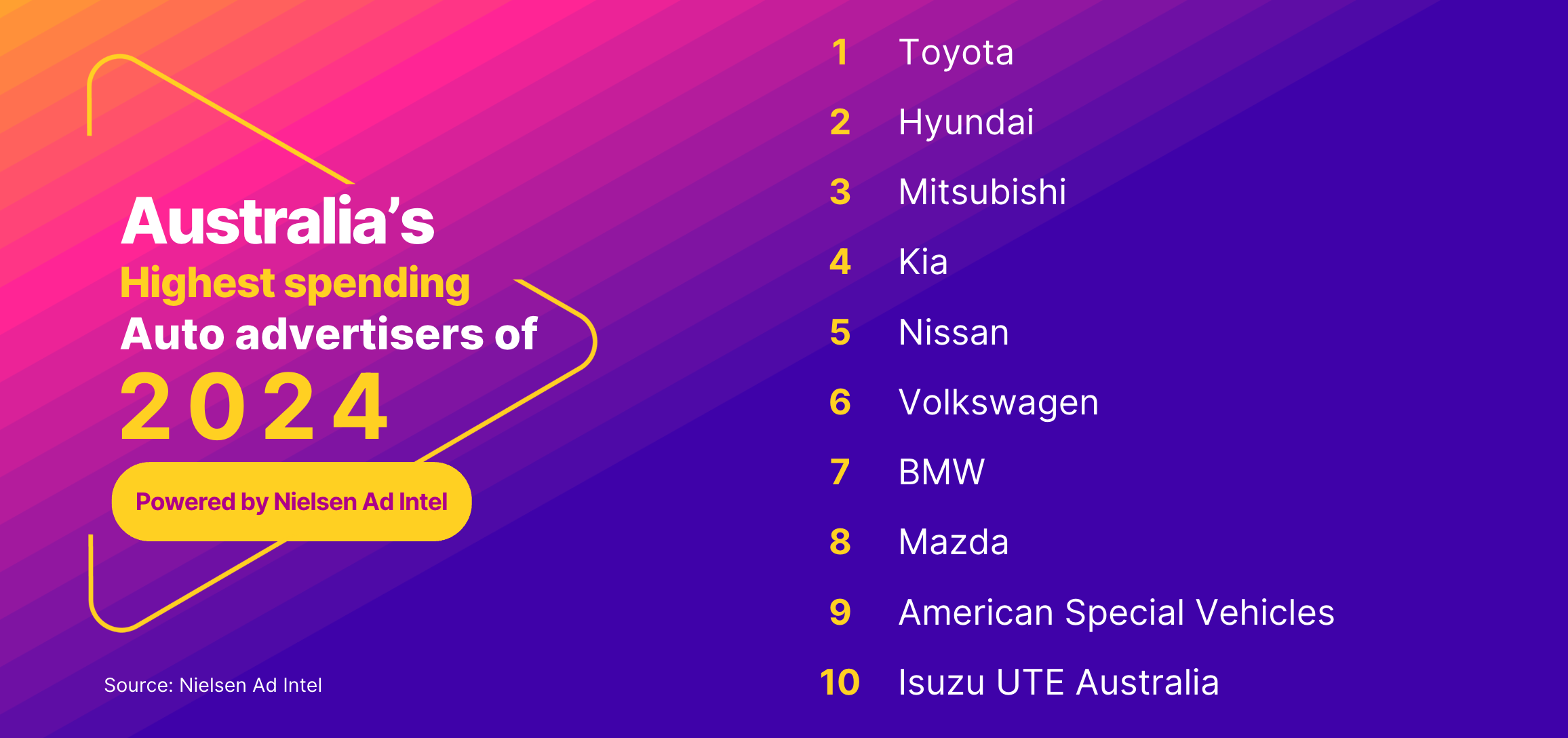

The increase in automotive advertising was driven by strong investment from the sector’s key players, as reflected by the list of Top 10 Ad spenders for the auto sector for FY 2024: 1. Toyota, 2. Hyundai, 3. Mitsubishi, 4. Kia, 5. Nissan, 6. Volkswagen, 7. BMW, 8. Mazda, 9. American Special Vehicles, 10. Isuzu UTE.

Additionally, Nielsen CMV data showed a growing consumer interest in electric vehicles (EVs) with 985,000 Australians (of driving age) saying the next car they buy will likely be electric – a 4.2% increase over the last 12 months.

These changing consumer preferences are reflected in the media spend, with ads in the EV sector jumping from $8.2 million in FY 2021 to $66.5 million in FY 2024 – an increase of 711% – bookending the exponential growth of $25.2 million in FY 2022 and $57 million in FY 2023.

The top five electric car models by ad spend in Australia for FY 2024 were: 1. Kia EV9, 2. Toyota BZ4X, 3. Nissan X-Trail SUV, 4. Polestar 2, 5. Kia EV6 GT.

Rose Lopreiato, Nielsen Ad Intel’s Australia Commercial Lead, said: “In today’s highly competitive automotive market, understanding where and how your competitors are investing in advertising is crucial. With the rapid rise of EVs, the shifting media landscape, and the influx of new players contributing to the overall increase in the sector’s ad investment, having a clear view of competitor advertising spend and media allocation enables them to make informed decisions, optimise their strategies, and gain a competitive edge, regardless of whether they’re in the Top 10 or not. Nielsen Ad Intel provides the transparency needed to do that, enabling brands to stay ahead in this rapidly evolving and complex industry.”

Glenn Channell, Nielsen’s Pacific Head of Advanced Analytics added: “As the automotive industry ramps up ad spend, especially on EVs, the need for precise and actionable insights has never been greater. The rise in both consumer interest and ad spend in the market highlights the need for advanced analytics tools, like Nielsen CMV, which provides the kind of quality data the market is crying out for, particularly when it comes to ensuring auto brands connect with their desired consumers at a time of massive change.”

In terms of media channels, the automotive sector’s advertising spend for FY 2024 was split across Metro TV (33%), General Display (20%), Regional TV (12%), Radio (12%), Social Media (9%), Out of Home (9%), Print (4%), and Cinema (1%).

*Source: Nielsen Ad Intel 2021 – 2024, & CMV 2024

About Nielsen

Nielsen shapes the world’s media and content as a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviours across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their audiences – now and into the future. Nielsen operates around the world in more than 55 countries.

Learn more at www.nielsen.com and connect with us on social media (Twitter, LinkedIn, Facebook and Instagram).

Media Contact

Dan Chapman

Assoc. Director, Communications, Nielsen APAC

[email protected]

+61 404 088 462