The post Nielsen data shows ad spend in Aus auto sector grew 8% over last 12 months, with EV media spend up sevenfold since 2021 appeared first on Nielsen.

]]>Sydney, Australia – August 19, 2024 – Nielsen has released its most recent Ad Intel and Consumer and Media View (CMV) data on the automotive industry in Australia, showing an 8% year-on-year increase in ad spend for the sector, topping $690 million for FY 2024.

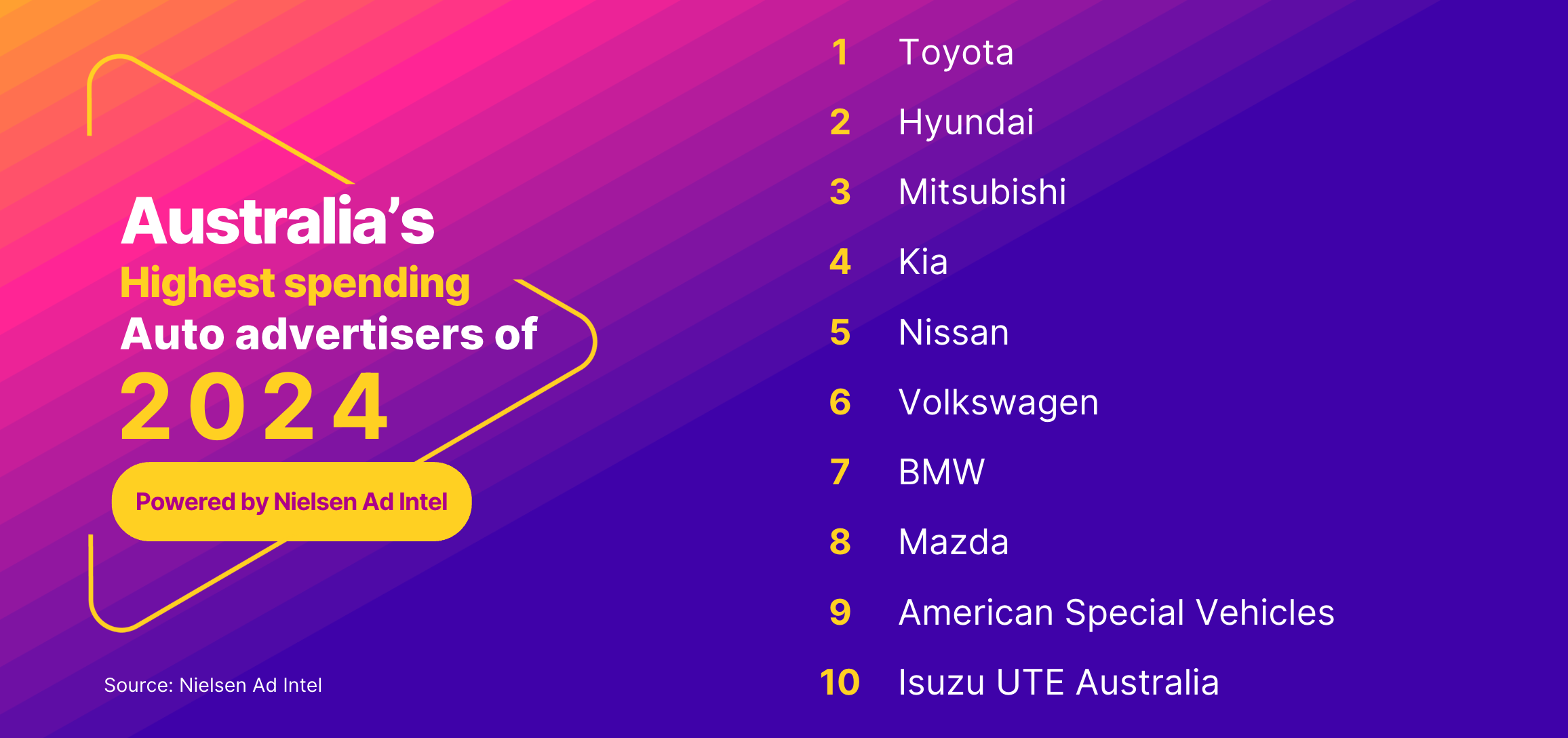

The increase in automotive advertising was driven by strong investment from the sector’s key players, as reflected by the list of Top 10 Ad spenders for the auto sector for FY 2024: 1. Toyota, 2. Hyundai, 3. Mitsubishi, 4. Kia, 5. Nissan, 6. Volkswagen, 7. BMW, 8. Mazda, 9. American Special Vehicles, 10. Isuzu UTE.

Additionally, Nielsen CMV data showed a growing consumer interest in electric vehicles (EVs) with 985,000 Australians (of driving age) saying the next car they buy will likely be electric – a 4.2% increase over the last 12 months.

These changing consumer preferences are reflected in the media spend, with ads in the EV sector jumping from $8.2 million in FY 2021 to $66.5 million in FY 2024 – an increase of 711% – bookending the exponential growth of $25.2 million in FY 2022 and $57 million in FY 2023.

The top five electric car models by ad spend in Australia for FY 2024 were: 1. Kia EV9, 2. Toyota BZ4X, 3. Nissan X-Trail SUV, 4. Polestar 2, 5. Kia EV6 GT.

Rose Lopreiato, Nielsen Ad Intel’s Australia Commercial Lead, said: “In today’s highly competitive automotive market, understanding where and how your competitors are investing in advertising is crucial. With the rapid rise of EVs, the shifting media landscape, and the influx of new players contributing to the overall increase in the sector’s ad investment, having a clear view of competitor advertising spend and media allocation enables them to make informed decisions, optimise their strategies, and gain a competitive edge, regardless of whether they’re in the Top 10 or not. Nielsen Ad Intel provides the transparency needed to do that, enabling brands to stay ahead in this rapidly evolving and complex industry.”

Glenn Channell, Nielsen’s Pacific Head of Advanced Analytics added: “As the automotive industry ramps up ad spend, especially on EVs, the need for precise and actionable insights has never been greater. The rise in both consumer interest and ad spend in the market highlights the need for advanced analytics tools, like Nielsen CMV, which provides the kind of quality data the market is crying out for, particularly when it comes to ensuring auto brands connect with their desired consumers at a time of massive change.”

In terms of media channels, the automotive sector’s advertising spend for FY 2024 was split across Metro TV (33%), General Display (20%), Regional TV (12%), Radio (12%), Social Media (9%), Out of Home (9%), Print (4%), and Cinema (1%).

*Source: Nielsen Ad Intel 2021 – 2024, & CMV 2024

About Nielsen

Nielsen shapes the world’s media and content as a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviours across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their audiences – now and into the future. Nielsen operates around the world in more than 55 countries.

Learn more at www.nielsen.com and connect with us on social media (Twitter, LinkedIn, Facebook and Instagram).

Media Contact

Dan Chapman

Assoc. Director, Communications, Nielsen APAC

[email protected]

+61 404 088 462

The post Nielsen data shows ad spend in Aus auto sector grew 8% over last 12 months, with EV media spend up sevenfold since 2021 appeared first on Nielsen.

]]>The post The Gauge™: Poland | July 2024 appeared first on Nielsen.

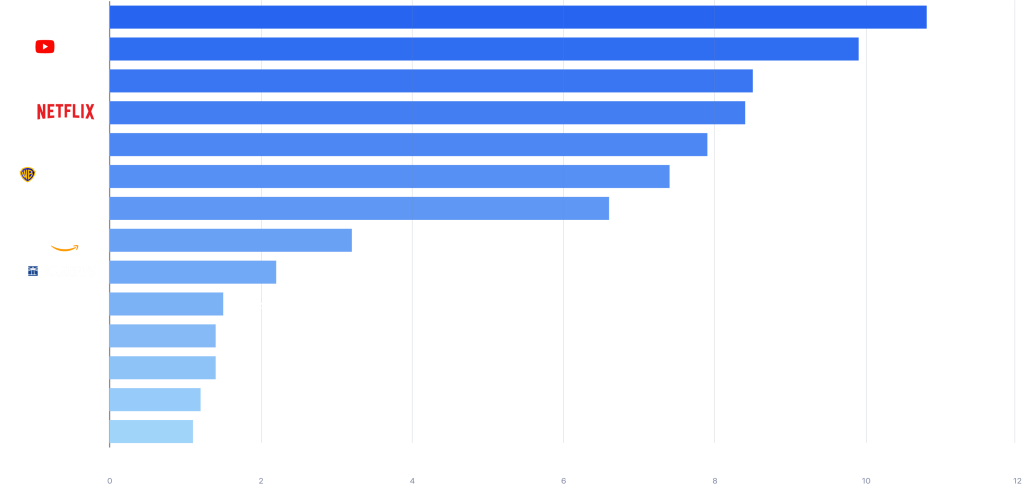

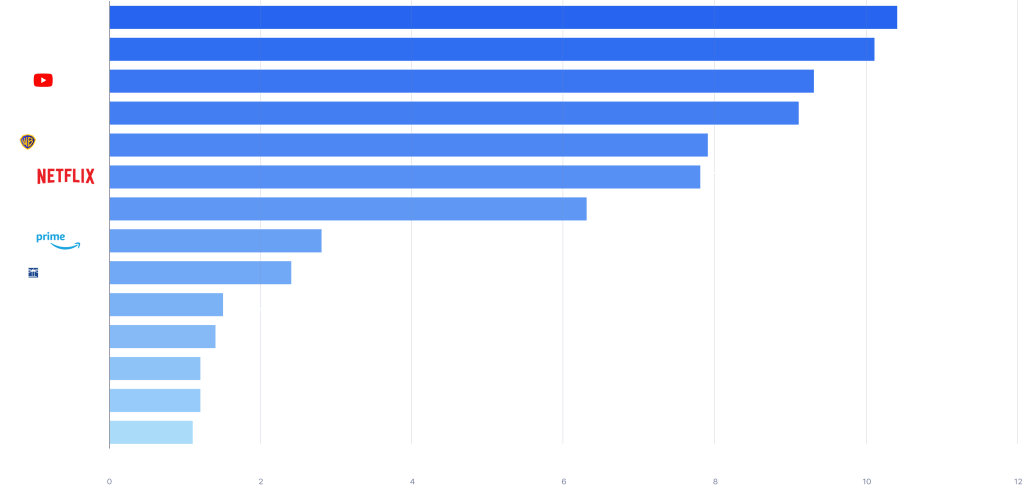

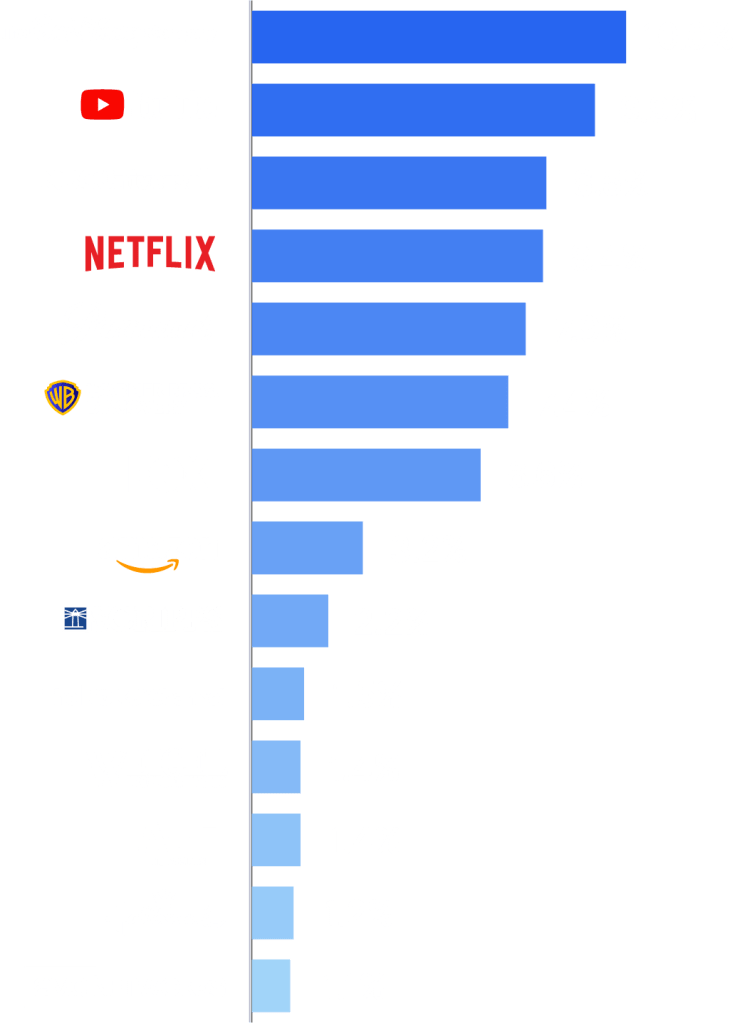

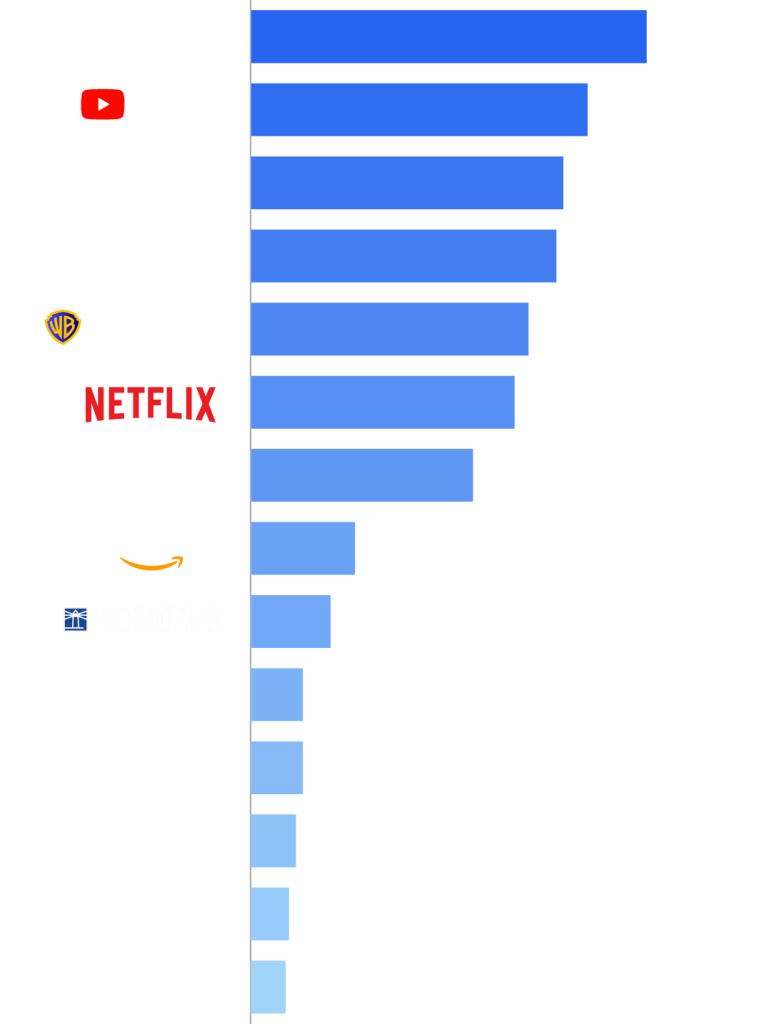

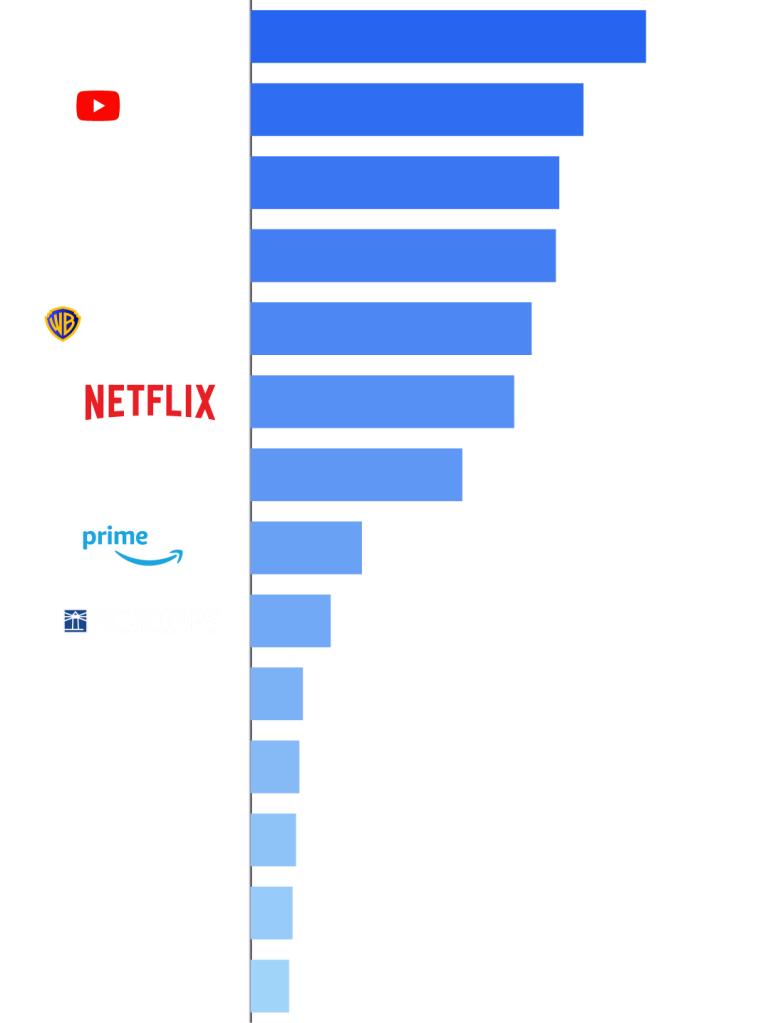

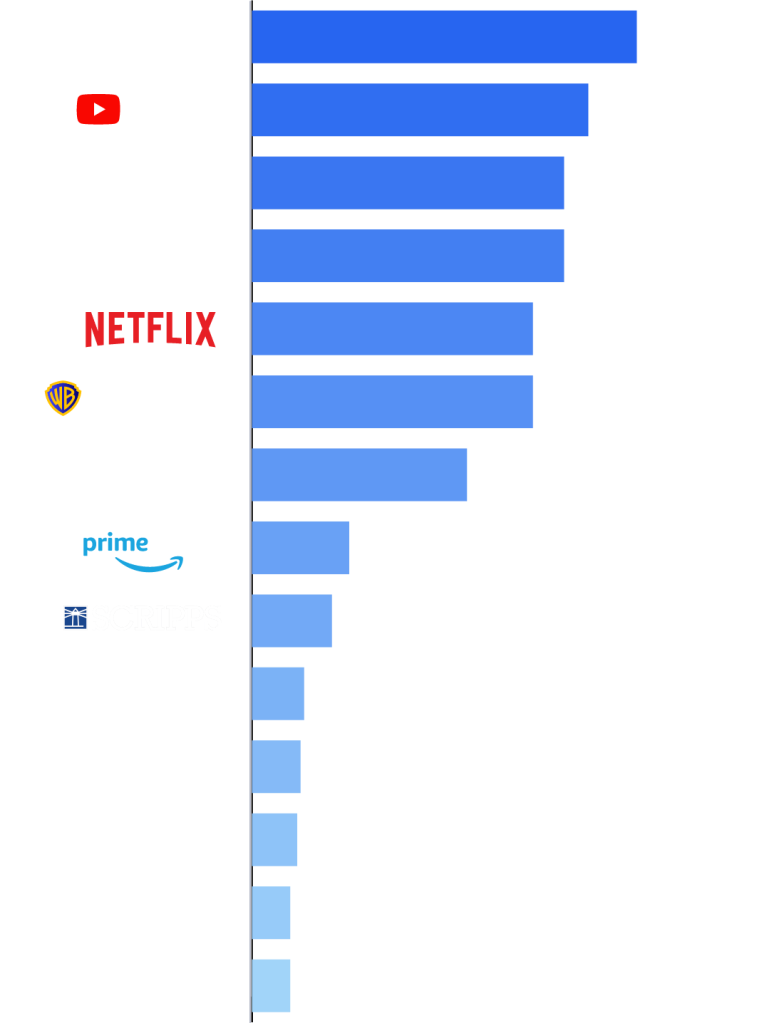

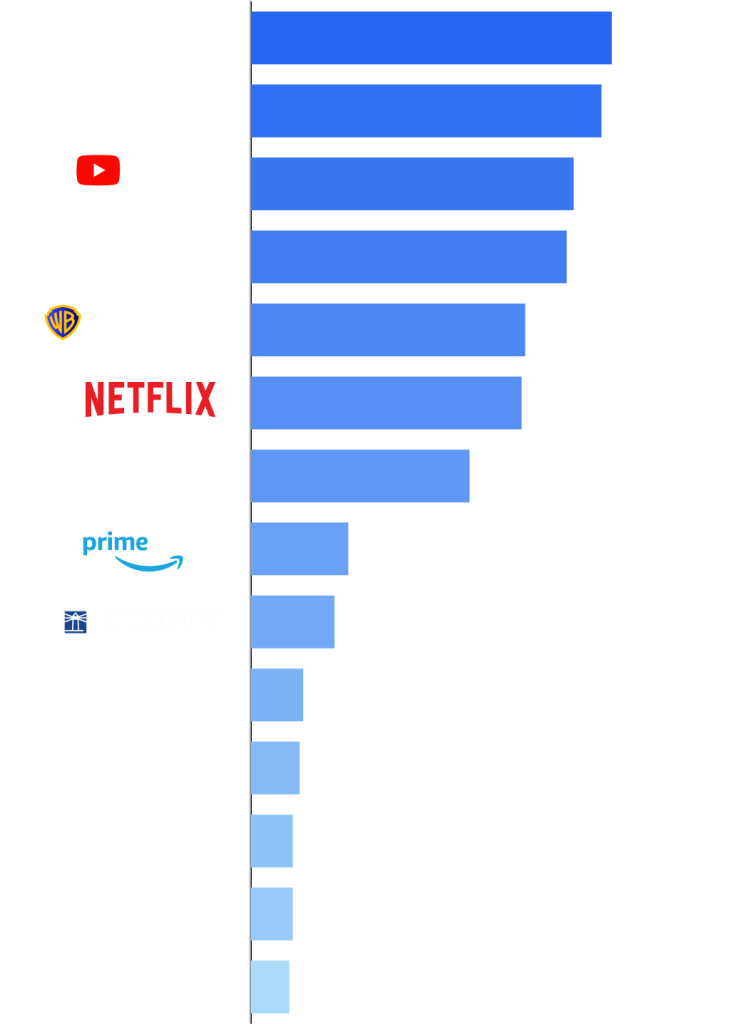

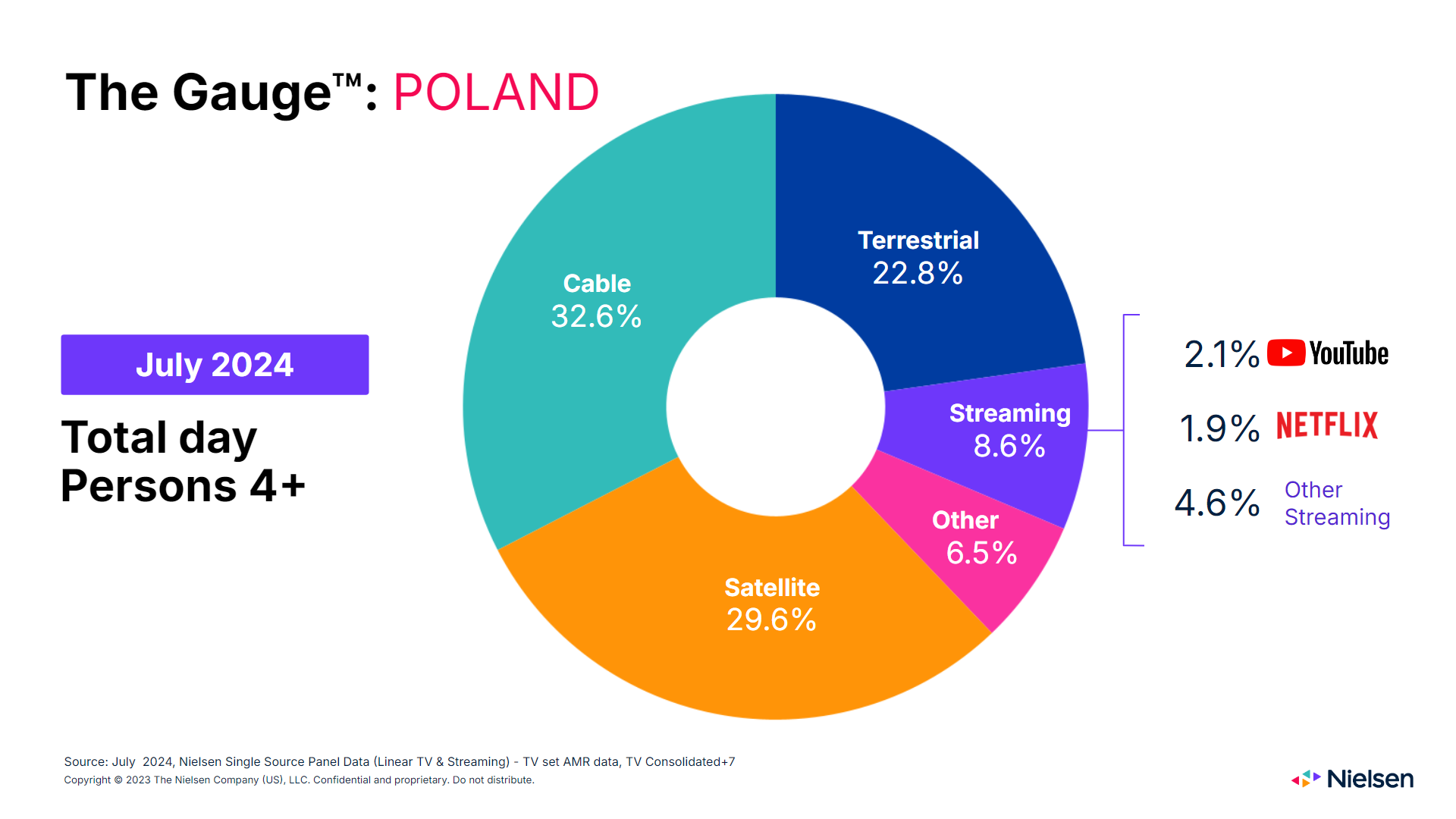

]]>The share of streaming viewing increased to 8.6% of total TV (from 8.3% in June). YouTube remained the streaming leader for the second month in a row, with its share unchanged at 2.1%. Netflix gained 0.2 percentage points, reaching 1.9% share of video content viewing on TV in July.

About The Gauge™

The Gauge™ was created to provide the media industry with a monthly analysis of television usage across key television delivery platforms. Nielsen published its first edition of The Gauge™ in the U.S. in May 2021.

About The Gauge™ Methodology

The data comes from Nielsen’s single-source panel consisting of 3,500 households and almost 9,700 panelists. The Gauge™: Poland is based on monthly AMR (Average Minute Rating) audience share data. The data is presented for people over 4 years old, broken down into cable, satellite, terrestrial television (both linear and shifted in time up to 7 days), and viewership from streaming (live streaming viewership of TV stations on OTT platforms is classified as streaming viewership). The “Other” category includes views of unrecognized content.

Nielsen Poland created this iteration of The Gauge™ using methodologies comparisons.

The post The Gauge™: Poland | July 2024 appeared first on Nielsen.

]]>The post The Gauge™: Mexico July 2024 appeared first on Nielsen.

]]>

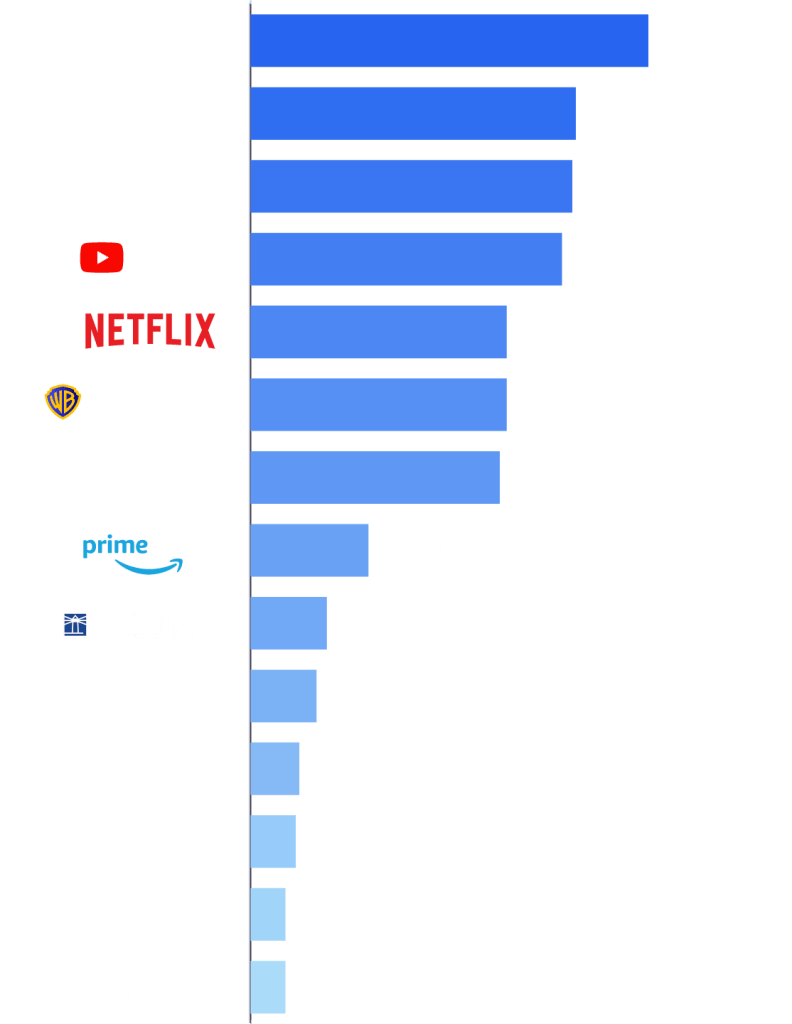

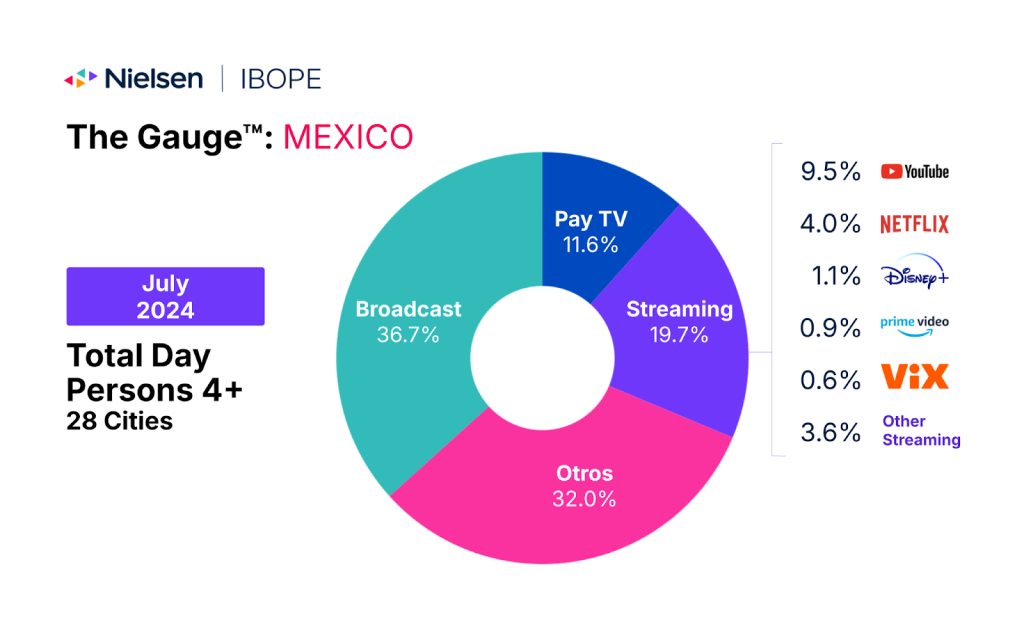

Disclaimer: YUMI TV, Streaming Ratings Transition Database – 450 Broadband and Non-Broadband HH from 28 main cities. Screen: TV. Target: People 4+. Universe People 4+: 58,404,410. Period: July 2024. Fringe: Total Day – 2:00 to 26:00 hrs. Audience type: Consolidated (Live+TSV 7 days+VOD). To be used as reference only.

METHODOLOGY & FAQ

This snapshot offers a monthly macro-analysis of how streaming-capable consumers access content through the main television distribution platforms, including over-the-air (Broadcast), streaming, restricted TV (Pay TV) and other sources (Others). The graph itself shows the viewing share by category and includes a breakdown of the top individual streaming distributors.

What is included in “Broadcast”?

Live and Time Shifted Viewing (TSV) audience of Open TV Channels broadcast contents that are referenced and reported in a disaggregated manner in the official Nielsen IBOPE TV audience measurement study (TAM) in Mexico, regardless of the used platform for viewing (Linear or recorded signal of the TV channel, streaming platforms, online transmission of the TV signal, etc).

What is included in “Pay TV”?

Live and Time Shifted Viewing (TSV) audience of Open TV Channels broadcast contents that are referenced and reported in a disaggregated manner in the official Nielsen IBOPE TV audience measurement study (TAM) in Mexico, regardless of the used platform for viewing (Linear or recorded signal of the TV channel, streaming platforms, online transmission of the TV signal, etc).

What is included in “Streaming”?

High bandwidth streaming events accessed through the household’s broadband network regardless of the used platform and that was not identified as part of the Broadcast or Pay TV buckets.

What is included in “Others”?

Includes the following:

- Live audience of linear content of TV channels which are not referenced, not disaggregated in the official Nielsen IBOPE TV audience measurement study (TAM) in Mexico and are not identified as video consumption streamed through the household’s broadband network.

- Use of peripheral devices (Game Consoles, Blu-rays, DVDs, etc.) connected to the TV when they are not being used to stream video content through the household’s broadband network.

- Non Audio Activity: Time periods in which no audio is detected on the TV set by the people meter.

The post The Gauge™: Mexico July 2024 appeared first on Nielsen.

]]>The post July Exhibits Rare Upswing in TV Viewing, Amplified by Streaming and First Days of Summer Olympics, according to Nielsen’s The Gauge™ appeared first on Nielsen.

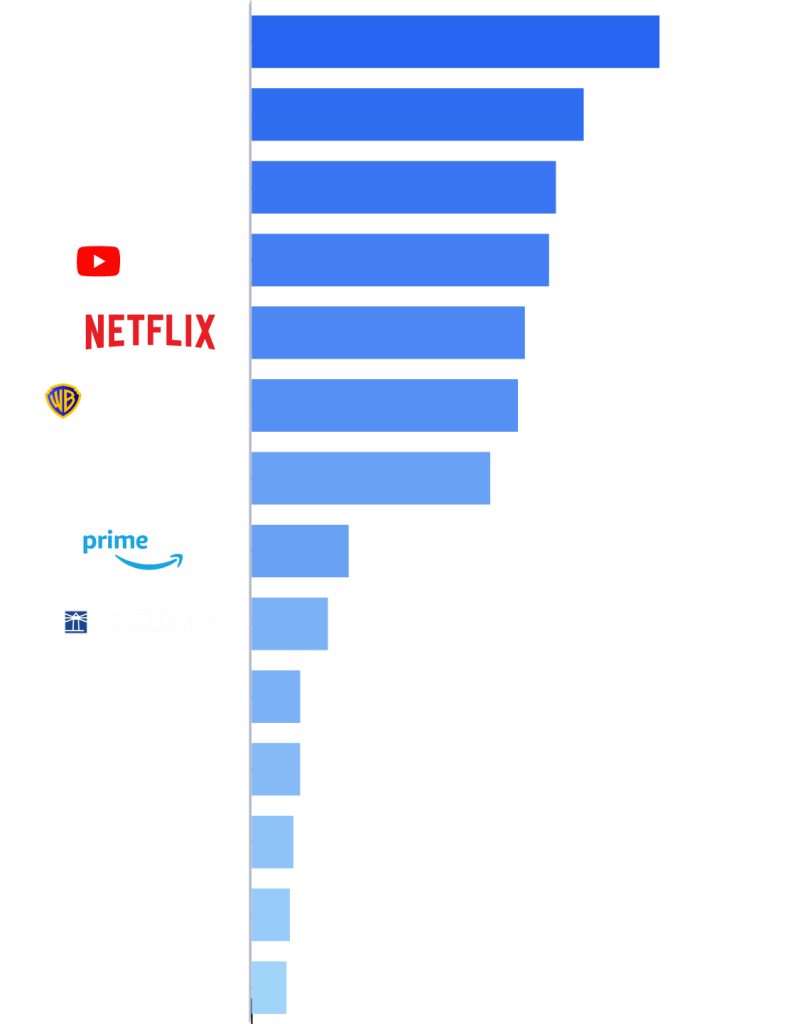

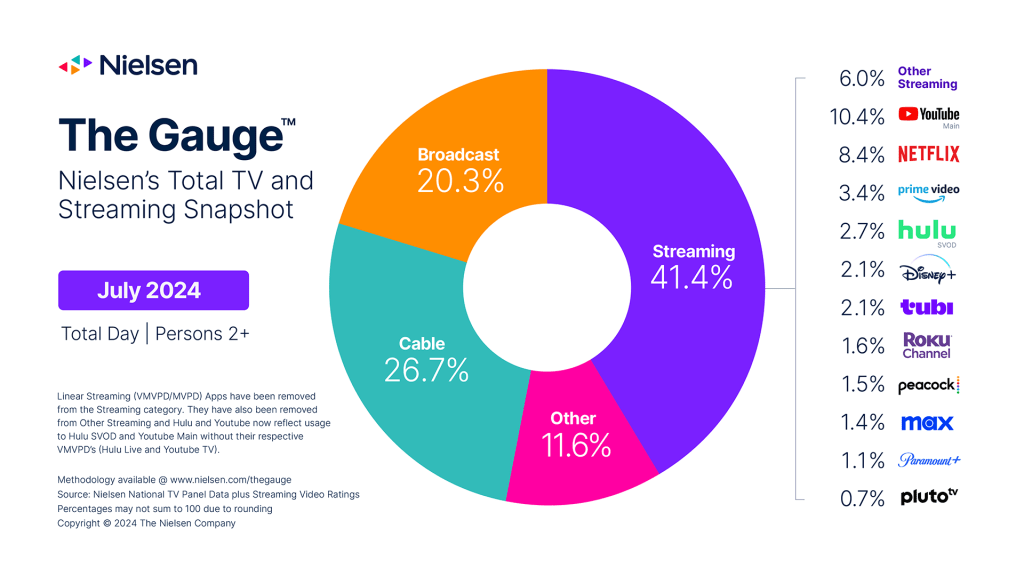

]]>Streaming hits 41.4% of TV, largest share for any viewing format in The Gauge’s history.

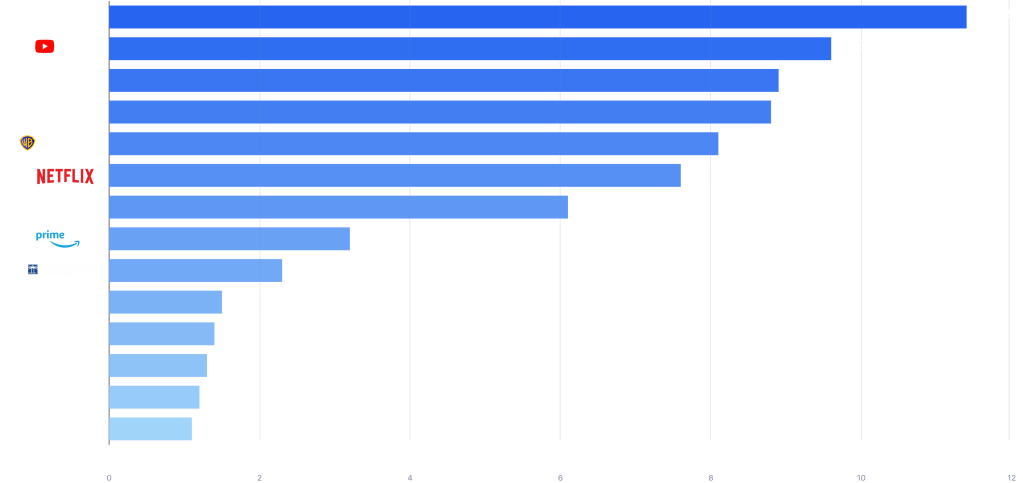

YouTube becomes first streaming platform to break 10% of total TV viewing.

NEW YORK – August 20, 2024 – Streaming made TV history for a second consecutive month in July as it notched the most dominant performance by a single viewing category ever in Nielsen’s The Gauge™, accounting for 41.4% of TV viewing. Streaming levels were over 5% higher in July compared to June, leading streaming to grow its share of TV by more than a point (+1.1 pt.) and shatter the previous record it set just last month.

July also ushered in the beginning of the Summer Olympics in Paris, and despite only three days of coverage included in the July Gauge report, the impact the Games had on TV viewing was evident. Total TV usage was up 2.3% in July compared to the previous month, and up 3.5% compared to July 2023. Broadcast viewing increased slightly this month to 20.3% of TV, but was up 5% compared to a year ago. The category also finished 0.3 points higher than July 2023 when it recorded its lowest share ever (20.0% of TV). When TV usage is isolated by week, the start of Olympics coverage in the final week of July pushed the broadcast average up to over 22% of total TV. This is further emphasized by the fact that the Olympics accounted for the top five, and seven of the top 10, broadcast telecasts in the July report, with the largest audience averaging 19 million viewers on NBC on Sunday, July 28.

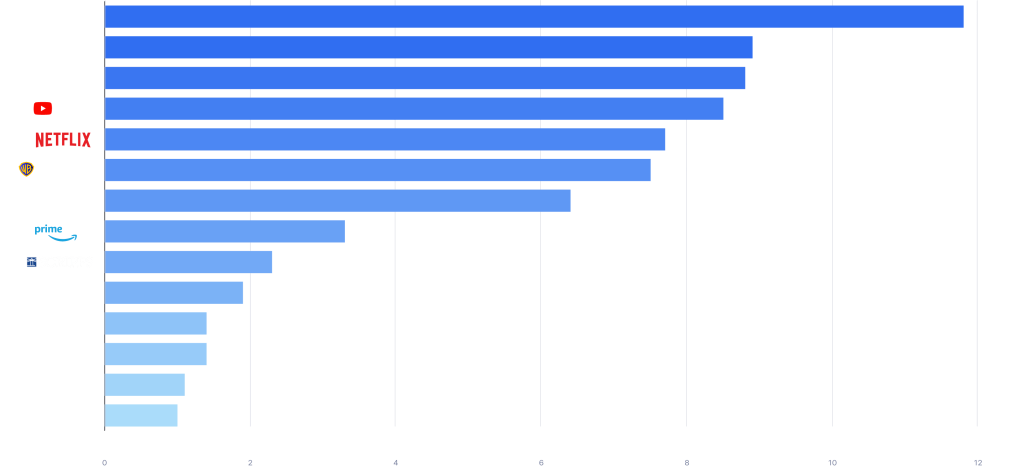

Peacock’s coverage of the Olympics vaulted the streamer to 1.5% of TV (+0.3 pt.) and its second best share of TV ever (behind 1.6% in Jan. 2024). Also boosted by viewing to Love Island USA, Peacock’s 33% monthly usage increase in July was the largest for any streaming platform in The Gauge. It was followed by two more streamers with double-digit monthly increases: Amazon Prime Video viewing was up 12% from June to notch 3.4% of TV (+0.3 pt.), its best since November 2023. The Roku Channel was up 10% and added 0.1 point to achieve a platform best 1.6% of TV.

July is typically a peak month for streaming usage, and this year, each week of the July interval* led to the top four most streamed weeks ever reported by Nielsen. The streaming fireworks kicked off with a notable week in Nielsen’s Streaming Top 10 when, for the first time ever, 10 titles exceeded 1 billion viewing minutes. What’s more, July 2024 now holds four of the top 10 most streamed days on record.

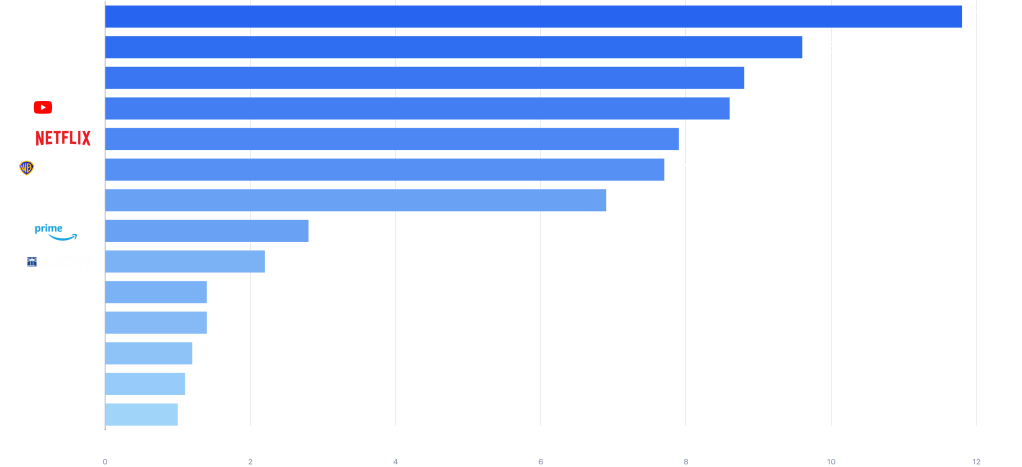

YouTube became the first streaming platform ever to exceed 10% of total TV usage in July. The most popular streamer shot up 7% versus last month, accounting for 10.4% of TV usage (+0.5 pt.). This comes after YouTube hit 9.9% of TV in June and secured the second largest share of TV viewing among all media distributors.

House of the Dragon on Max topped streaming programs in July with 4.7 billion viewing minutes, also helping to drive an increase of over 4% for the streamer to retain its 1.4% share of TV. It was followed by Bluey on Disney+ with 4.3 billion viewing minutes in July. Disney+ usage was up 9.2% this month to finish with a platform best 2.1% of TV. Prime Video’s original series The Boys was third among streaming programs with 4.2 billion viewing minutes.

Cable viewing in July was even compared to June, but due to the larger increase of overall TV usage, the category lost half a share point and ended the month with 26.7% of TV. Cable news viewing saw a strong increase in July, driven by the Republican National Convention and coverage of the assassination attempt on former President Trump. The news genre was up 23% compared to June, and up 52% compared to July 2023. Of July’s top 25 cable telecasts, Fox News Channel owned 24 of them.

* The measurement month of July 2024 included four weeks: 07/01/2024 through 07/28/2024. Nielsen measurement weeks begin on Mondays and run through the following Sunday.

About The Gauge™

The Gauge™ is Nielsen’s monthly snapshot of total broadcast, cable and streaming consumption that occurs through a television screen, providing the industry with a holistic look at what audiences are watching. The Gauge was expanded in April 2024 to include The Media Distributor Gauge, which reflects total viewing by media distributor across these categories. Read more about The Gauge methodology and FAQs.

About Nielsen

Nielsen is a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviors across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their global audiences—now and into the future. Learn more at www.nielsen.com and connect with us on social media (X, LinkedIn, YouTube, Facebook and Instagram).

Press Contact

Lauren Pabst

[email protected]

The post July Exhibits Rare Upswing in TV Viewing, Amplified by Streaming and First Days of Summer Olympics, according to Nielsen’s The Gauge™ appeared first on Nielsen.

]]>The post Nielsen data shows Australian tertiary education institutions spent more than $175m on ads in last 12 months appeared first on Nielsen.

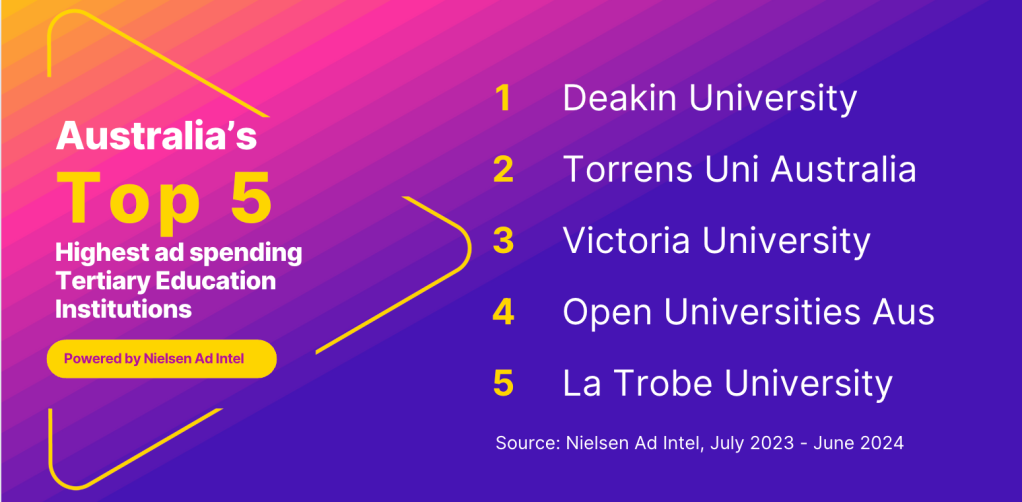

]]>Sydney – August 7, 2024 – Nielsen has released its most recent Ad Intel and Consumer and Media View (CMV) data on the tertiary education sector in Australia, revealing a significant increase in the number of people looking to pursue higher education and the institutions spending big to attract them.

According to Nielsen CMV, the percentage of Australians (aged 16 and above) expressing an intention to study at TAFE or University in the next 12 months has risen dramatically. In 2019 the number was just 7%, more than doubling to 15% in 2023, before rising to 22% in 2024.

Additionally, Nielsen Ad Intel data shows that Australian tertiary education providers are spending big to attract new students, with a combined ad spend topping $175.5 million between July 2023 and June 2024. Notably, there was an increase of 19% from May to June this year alone.

Social media accounted for 60% of the total ad spend by institutions, with general display also heavily used in the ad mix.

Predictably, the largest group intending to undertake tertiary study within the upcoming year are high school graduates aged 16 to 17, however older generations are also looking to hit the books.

Age breakdown of those intending to undertake tertiary study in the next 12 months:

16-17: 49%

18-24: 18%

25-39: 22%

40-54: 17%

55+: 4%

The data also reveals that 75% of those wanting to pursue tertiary education over the course of the following year are currently employed, with 44% working full time, 31% working part-time, and 18% working casually, indicating a desire to upskill and improve their qualifications.

In addition, 54% of those intending to study are parents, or have children at home. Among this group, 20% have at least one child under 5 years old, 27% have at least one child between 5-12 years old, and another 27% have at least one child between 13-17 years old.

Nielsen Ad Intel’s Australia Commercial Lead, Rose Lopreiato, said: “This sector is so important – for the institutions, the students, and the country as a whole – and that’s reflected in the ad spend numbers. They demonstrate the difficulty of attracting students as they consider their TAFE or university options in such a competitive market and highlight the need for education providers to reach the right demographics, in the right places, at the right time – and nothing does that better than Ad Intel”.

Glenn Channell, Nielsen’s Pacific Head of Advanced Analytics added: “High school graduates aside, more and more Australians are considering tertiary education, so it’s never been more crucial for tertiary institutions to offer educational opportunities and career advancement to an increasingly diverse range of people, especially those with family commitments. Nielsen CMV allows them to do that – viewing potential Tertiary Education customers through an advanced audience lens, delivering a more holistic picture of behaviours, preferences, and lifestyle habits unmatched in the market.”

When it comes to ads, Australian secondary students looking to pursue tertiary education in the next 12 months are 75% more likely than the average population to respond to online ads, 2.5 times more likely to click on video ads, and almost 2.8 times as likely to click on banner ads. Additionally, 32% find online and mobile ads useful, if tailored to their interests, which is 48% higher than the average population.

*Source: Nielsen CMV, July 2019 – June 2020, July 2022-June 2023, July 2023 – June 2024, base: All People 16+ and;

Nielsen Ad Intel, July 2023 – June 2024

About Nielsen

Nielsen shapes the world’s media and content as a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviours across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their audiences – now and into the future. Nielsen operates around the world in more than 55 countries.

Learn more at www.nielsen.com and connect with us on social media (Twitter, LinkedIn, Facebook and Instagram).

Media Contact

Dan Chapman

Assoc. Director, Communications, Nielsen APAC

[email protected]

+61 404 088 462

The post Nielsen data shows Australian tertiary education institutions spent more than $175m on ads in last 12 months appeared first on Nielsen.

]]>The post Nielsen & Innovid Collaborate to Provide Seamless Workflow & Holistic View of the Cross-Media Ads Universe appeared first on Nielsen.

]]>NEW YORK – August 6, 2024 – Nielsen, a global leader in audience measurement, data, and analytics, and Innovid (NYSE:CTV), an independent advertising platform for the delivery, personalization, and measurement of converged TV across linear, CTV, and digital, today announced their collaboration with the aim to bring simplicity and enhanced enablement to ad measurement. By leveraging Innovid’s ad serving infrastructure to access Nielsen ONE, Nielsen and Innovid would provide a seamless workflow, ultimately driving greater usability and coverage for ad measurement across platforms.

Nielsen has been at the forefront of driving cross-media audience measurement and through Nielsen ONE is providing the industry with a deduplicated view of ads and programs across linear, streaming, and digital. The companies are teaming up to evaluate a ground-breaking zero-touch workflow that would let the industry, including advertisers and agencies, benefit from Nielsen ONE reporting seamlessly. The simplified workflow would increase data quality, reduce operational workload, and allow Nielsen ONE customers to leverage Innovid’s full coverage of the streaming universe.

Bringing together the leader in cross-media audience measurement with Innovid’s unique framework and unprecedented view of the CTV and programmatic universe would enable efficiencies as well as bring greater scale and coverage to Nielsen ONE. Ultimately, the companies aim to provide the industry with a holistic, comprehensive view of cross-media ad campaigns.

Nielsen and Innovid will be testing the technical integration in the coming months.

Karthik Rao, CEO, Nielsen

“We’re excited to collaborate with Innovid to explore how combining our unique capabilities can make a greater positive impact on the future of audience measurement. Nielsen’s work to capture all the ways that people engage with content and ads is essential so that advertisers, creators and the industry know what’s being watched and we continue to innovate on top of our leading measurement approach to better serve the changing industry.”

Zvika Netter, CEO & Co-Founder, Innovid

“Nielsen’s robust industry footprint and methodology continue to make it the go-to standard for media trading and measurement. By joining forces and combining our technology, data, and scale, we will help build a better, more transparent, and accessible TV ecosystem for every advertiser. “

About Nielsen

Nielsen is a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviors across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their global audiences—now and into the future. Learn more at www.nielsen.com and connect with us on social media (X, LinkedIn, YouTube, Facebook and Instagram).

About Innovid

Innovid (NYSE:CTV) is an independent software platform for the creation, delivery, measurement, and optimization of advertising across connected TV (CTV), linear, and digital. Through a global infrastructure that enables cross-platform ad serving, data-driven creative, and measurement, Innovid offers its clients always-on intelligence to optimize advertising investment across channels, platforms, screens, and devices. Innovid is an independent platform that leads the market in converged TV innovation, through proprietary technology and exclusive partnerships designed to reimagine TV advertising. Headquartered in New York City, Innovid serves a global client base through offices across the Americas, Europe, and Asia Pacific. To learn more, visit https://www.innovid.com/ or follow us on LinkedIn or X.

Press Contact

Sarah Muratore

[email protected]

The post Nielsen & Innovid Collaborate to Provide Seamless Workflow & Holistic View of the Cross-Media Ads Universe appeared first on Nielsen.

]]>The post July 4th Fireworks: Multiple Viewing Records Set in Nielsen’s Most-Streamed Week Ever from July 1 – 7 appeared first on Nielsen.

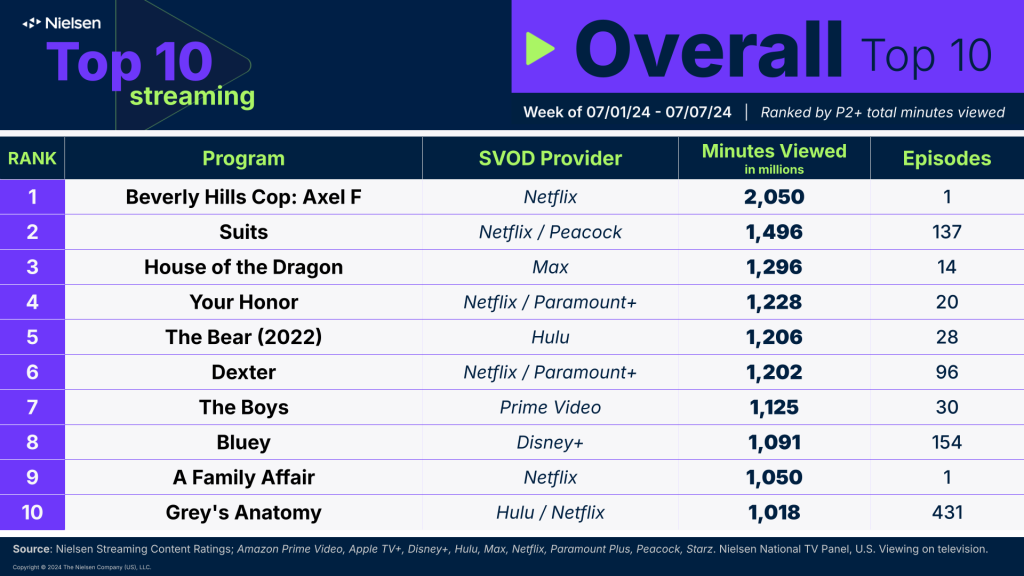

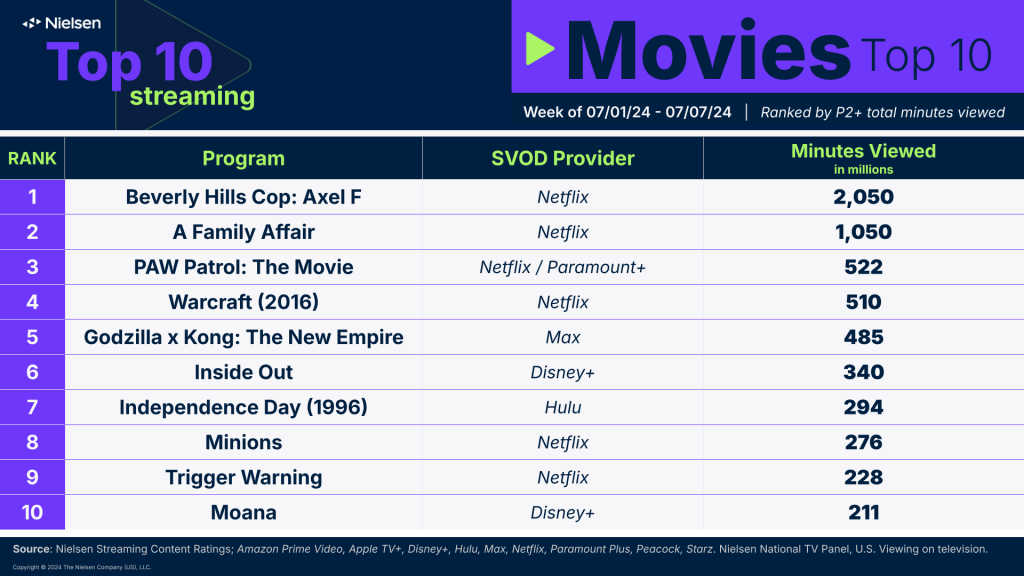

]]>‘Beverly Hills Cop: Axel F’ takes top spot, followed by ‘Suits,’ ‘House of the Dragon,’ ‘Your Honor’ and ‘The Bear’

August 1, 2024 – The week of July 1 – July 7 recorded over 313 billion viewing minutes across streaming platforms*, representing the highest level of streaming consumption ever for a single measurement week in Nielsen’s Streaming Top 10. Furthermore, Sunday, July 7 notched the fourth-highest daily level of streaming viewership ever recorded by Nielsen. It is outdone only by three other weekend dates with holiday ties: January 13, 2024—the most-streamed day on record—which included the NFL Wild Card playoff game on Peacock, and this year’s cold, post-Super Bowl weekend, February 17 and 18.

The July holiday week also left its mark on Nielsen’s Streaming Top 10 charts: For the first time ever, all 10 titles on the overall list exceeded 1 billion viewing minutes. This crushes the previous record of seven billion-minute titles in a single week, which had only happened twice before. Moreover, in nearly five years of weekly Top 10 reports, only 25% of charting titles have ever crossed the billion minute threshold, further emphasizing the extraordinary nature of the week.

It’s not uncommon for holiday weeks to coincide with notable upticks in TV watch time, and over the past few years, summer holidays have aligned with explosive jumps in streaming viewership. The Fourth of July holiday week in particular is a big driver of this phenomenon and in the past two years has included a 3.8 billion minute performance by Suits in 2023, and 4.8 billion minutes for Stranger Things in 2022.

This banner week, which highlighted high streaming volume despite lower single title peaks, was led by the Netflix summer flick Beverly Hills Cop: Axel F. The Eddie Murphy movie drew 2.05 billion viewing minutes and inspired a walk down memory lane for many, as half of its viewers were over 50.

Looking back at the same week in 2023 (July 3 – July 9, 2023), four of this week’s billion-minute titles are back on the overall list one year later.

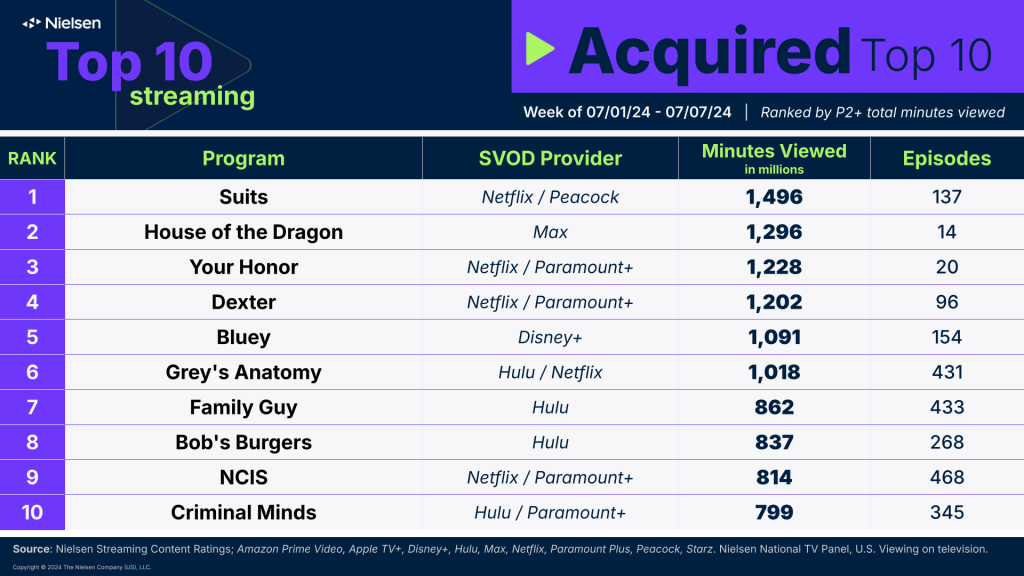

•Suits, reenergized by new episodes flowing to Netflix from Peacock, solidified the #2 spot with 1.5 billion viewing minutes.

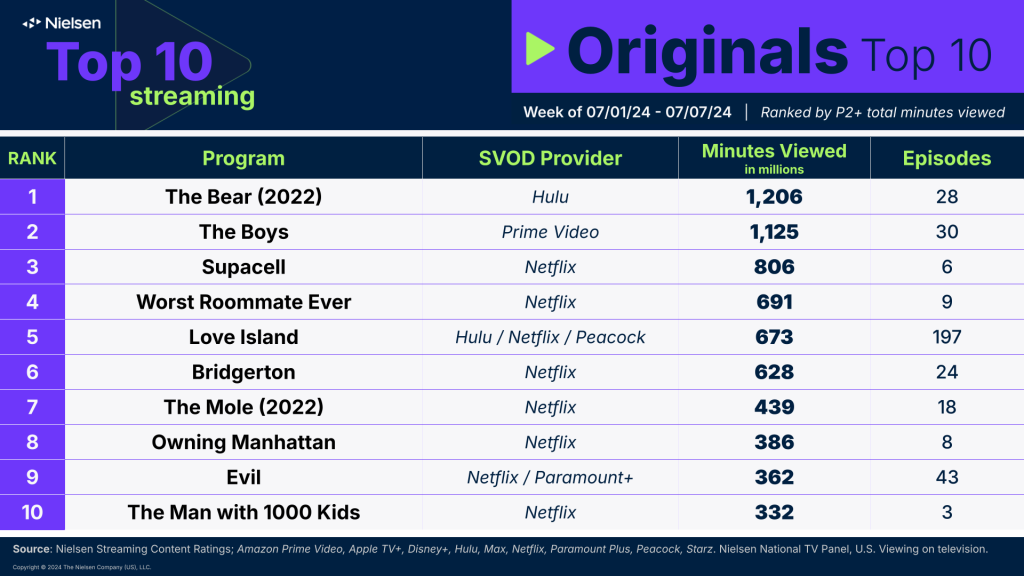

•Hulu’s The Bear added a new season during the previous measurement week and drummed up 1.2 billion viewing minutes across all 28 episodes in this interval, notching #5 overall.

•The kid-favorite Bluey on Disney+ captured its 14th consecutive billion-minute week, landing at #8 overall with 1.09 billion minutes.

•Grey’s Anatomy on Hulu and Netflix was the 10th billion-minute title this week with a total of 1.02 billion viewing minutes.

Across the remaining five titles in the billions: House Of The Dragon on Max came in at #3 with 1.3 billion minutes (+24% from the previous. week). On Netflix and Paramount+, Bryan Cranston’s Your Honor captured the #4 spot with 1.23 billion minutes, and Dexter (which was recently added to Netflix) came in at #6 with 1.2 billion. Prime Video’s original series The Boys notched a fourth week with over a billion minutes (1.13B) to snag #7 overall. And at #9, the Netflix rom-com Family Affair starring Zac Efron and Nicole Kidman totaled 1.05 billion minutes this week.

Honorable mention this week goes to the Netflix original, Supacell, which generated 806 minutes (+46%) and would have cracked the overall Top 10 in virtually every other interval measured. It has broad appeal across adult viewers and was driven by a 75% multicultural audience.

*According to Nielsen Streaming Platform Ratings.

Press Contact

Lauren Pabst

[email protected]

The post July 4th Fireworks: Multiple Viewing Records Set in Nielsen’s Most-Streamed Week Ever from July 1 – 7 appeared first on Nielsen.

]]>The post Gracenote teams with major connected TV (CTV) players to optimize contextual ad targeting appeared first on Nielsen.

]]>New York, NY – July 25, 2024 – Gracenote, the content data business unit of Nielsen, is powering new contextual categories to give advertisers greater visibility into the content that their messages run against on connected TV (CTV). By teaming with Peer39, the leading global provider of contextual suitability and quality solutions for modern marketers, these Gracenote-powered contextual CTV categories will be available on Peer39 partner DSP platforms for the first time enabling programmatic CTV ad buys. Additionally, Gracenote has tapped Magnite (NASDAQ: MGNI), the largest independent omnichannel sell-side advertising company, as the first SSP to support and scale these new CTV categories

Publishers including Cineverse, DIRECTV Advertising, Philo, Tastemade and Xumo can enhance their programming with Gracenote Contextual Video Data which describes individual TV shows and movies to provide more visibility and transparency for media buyers who want additional signals around content. Agencies including Cannella Media and Ocean Media intend to use Gracenote CTV categories to optimize targeting and deliver incremental reach.

High quality Gracenote metadata has long been trusted by the world’s leading publishers and streamers to power innovative video experiences and advanced content discovery. With this announcement, Gracenote is making its gold-standard program genres, ratings, content types and advisories available as the common taxonomy for media buyers and sellers to transact direct and programmatic CTV buys on.

“For CTV advertising to reach its full potential, scale and transparency are critical,” said Trent Wheeler, Chief Product Officer at Gracenote. “Gracenote is uniquely positioned to become the taxonomy for the CTV marketplace providing program-level metadata for sellers and buyers to transact on. The insight into content enabled by Gracenote Contextual Video Data will help publishers optimize their CTV inventory and advertisers reach target audiences at scale.”

Gracenote data provides unprecedented granularity at scale for programmatic ad buys. Publishers can use Gracenote’s deep descriptive metadata to package ad inventory to unlock incremental revenue for content catalogs. Magnite’s controls allow publishers to determine when this content metadata is shared with advertisers.

For example, if a sports documentary is only identified as a “documentary,” it may miss out on suitable bids for “sports enthusiasts” and other sports categories, limiting incremental reach. A “drama” set in Paris could have multiple sub-genres such as “fashion” and “travel” that would appeal to luxury goods or airline advertisers opening new ad matching opportunities. CTV publishers and content owners can be assured that media buyers will not have access to show, series or episode titles for targeting.

“CTV represents the future of television advertising and the ability to pass standardized contextual data signals at scale will improve results for advertisers and lead to more investment for publishers,” said Mario Diez, CEO of Peer39. “We’ve spent the past several years looking to bring more effectiveness to CTV ad targeting. Together with Gracenote, we hope to create a strong ecosystem where advertisers, publishers and consumers all benefit from content supported through contextually relevant advertising.”

Making Gracenote’s contextual CTV categories available through Peer39 will allow advertisers and agencies to better understand available programming and more effectively target audiences to achieve their advertising goals. Media buyers can also use keyword targeting to match against or exclude actor, director, sports type, mood, theme, subject, location and other types of in-content metadata. Gracenote’s program ratings and parental advisory categories give brands the confidence to lift channel blocks while avoiding unsuitable content.

“Magnite is pleased to be working with Gracenote to scale the use of standardized contextual categories to improve CTV advertising outcomes and as our collaboration continues, we’ll innovate together to facilitate the adoption, scale, and distribution of Contextual Video Data,” said Kristen Williams, SVP of Strategic Partnerships at Magnite. “In addition to experimenting with different packages based on contextual use cases, we are discussing additional features including more robust data controls for media owners. We look forward to working closely with Gracenote and our partners to increase collaboration through contextual insights.”

The addition of Gracenote metadata adds new content-level control to Peer39 and creates the most scaled and precise set of CTV data available to the marketplace. This forms the foundation of a better CTV advertising ecosystem in which publishers, agencies and brands benefit. DSPs, SSPs and publishers either already leveraging or planning to leverage the new Gracenote categories through Peer39 include Basis, Cadent, DeepIntent, Illumin (formerly Acuity), Index Exchange, Infillion (formerly Mediamath), Magnite, Microsoft (formerly Xandr), Plex, Viant (formerly Adelphic) and Yahoo.

Industry Supporters

Cannella Media: “Cannella Media is excited to work with Gracenote and leverage its contextual program metadata,” said Chris Brombach, SVP, Media and Strategy at Cannella Media. “We are confident that efficient access to CTV inventory and enhanced targeting enabled by Gracenote will allow us to build on our successful CTV campaign strategies—ultimately driving increased profitability for our clients.”

DIRECTV Advertising: “At DIRECTV Advertising, we are committed to providing our advertisers the tools to reach their audiences most effectively,” said Matt Jamison, AVP, Head of Ad Sales Partnerships at DIRECTV Advertising. “By integrating Gracenote’s content metadata, we can offer brands more precision in the content they’re airing within, as well as more transparency on the backend. This collaboration marks a significant step forward in enhancing our CTV advertising capabilities, enabling us to deliver more relevant and impactful ads to our viewers.”

Ocean Media: “Contextual signals are critical to optimizing campaigns for our brands so we look forward to advancements here,” said Kevin Telkamp, VP, Media Operations at Ocean Media. “Since Connected TV devices are often shared between individuals in the same household, content classification helps to distinguish and better address the optimal consumers for brand messages. We are excited about Gracenote’s new standardized contextual data offering and the potential it holds for the betterment of the CTV ecosystem.”

Philo: “Context is a key component that allows advertisers to place their ads within programming that is brand-safe and most effectively supports their message to consumers,” said Reed Barker, Head of Advertising at Philo. “With Gracenote’s innovative contextual categories, Philo can offer advertisers unparalleled insight into our content, resulting in more effective and impactful ad campaigns. This partnership marks a significant step forward in our mission to provide both our audience and advertisers with the best possible streaming experience.”

Tastemade: “Tastemade is a leader in passing as much content metadata as possible, so we’ve seen firsthand how a lack of standardization can be an inhibitor to buyers,” said Evan Bregman, General Manager, Streaming at Tastemade. “We’re excited to partner with Gracenote to overcome this hurdle and make it easy for advertisers to transact against contextual segments at scale.”

Xumo: “Xumo is optimistic about the power of contextual advertising to help brands reach target consumers by aligning with programming,” said Jerrold Son, Vice President, Ad Integrations & Operations at Xumo. “A standard taxonomy which both sellers and buyers can rely on is a critical component to the success of this type of targeting, and we’re pleased that Gracenote is making their trusted metadata, IDs and taxonomy available to the ecosystem.”

Yahoo: “We’ve seen repeatedly that relevant ads drive higher attention, and ensuring advertisers have transparency into the type of content they are bidding against is critical for guiding strategies that deliver results,” said Beau Ordemann, VP of Advanced TV at Yahoo. “This offering will be beneficial for advertisers trying to reach target audiences by providing enhanced contextual relevance. We look forward to bringing this offering to Yahoo DSP clients and helping them meet their objectives even further.”

About Gracenote

Gracenote is the content data business unit of Nielsen, providing entertainment metadata, content IDs and related offerings to the world’s leading creators, distributors and platforms. Gracenote has aggregated, normalized and enriched core program metadata covering 30M titles in 360 streaming catalogs in 35 languages and 60 countries. Gracenote technology enables advanced content navigation and discovery capabilities helping individuals to easily connect to the TV shows, movies, music and sports they love while delivering powerful content analytics making complex business decisions simpler. For more information, visit Gracenote.com.

About Peer39

Peer39 is the leading global provider of contextual suitability and quality solutions for modern marketers. The company’s AI-powered semantic analysis engine is used by thousands of brands, agencies, and publishers to better understand content across web, CTV, in-app mobile, and online video ad placements. Peer39’s targeting, measurement, analytics, and suitability & safety tools are all informed by privacy-compliant, cookie-free data. This ensures that these solutions will help advertisers now, and well into the future of media. For more information, visit Peer39.com.

The post Gracenote teams with major connected TV (CTV) players to optimize contextual ad targeting appeared first on Nielsen.

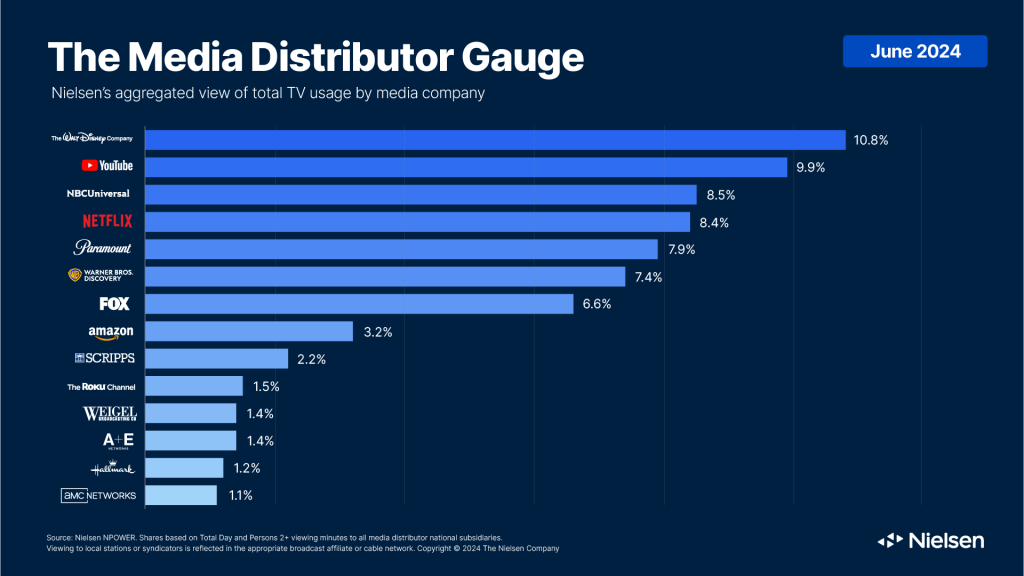

]]>The post Netflix Makes Biggest Jump in Nielsen’s June Media Distributor Gauge, Up Nearly 12% From May appeared first on Nielsen.

]]>Disney holds #1 spot driven by strong Disney+ performance.

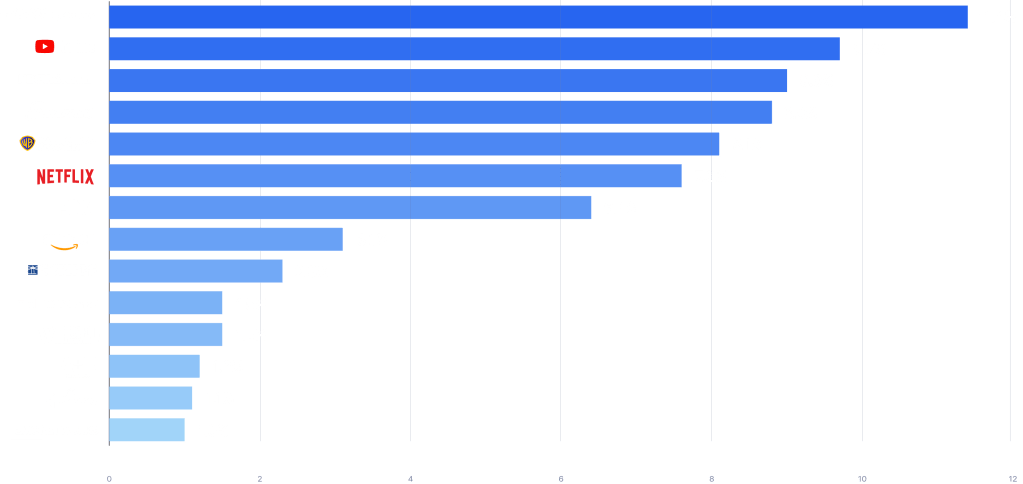

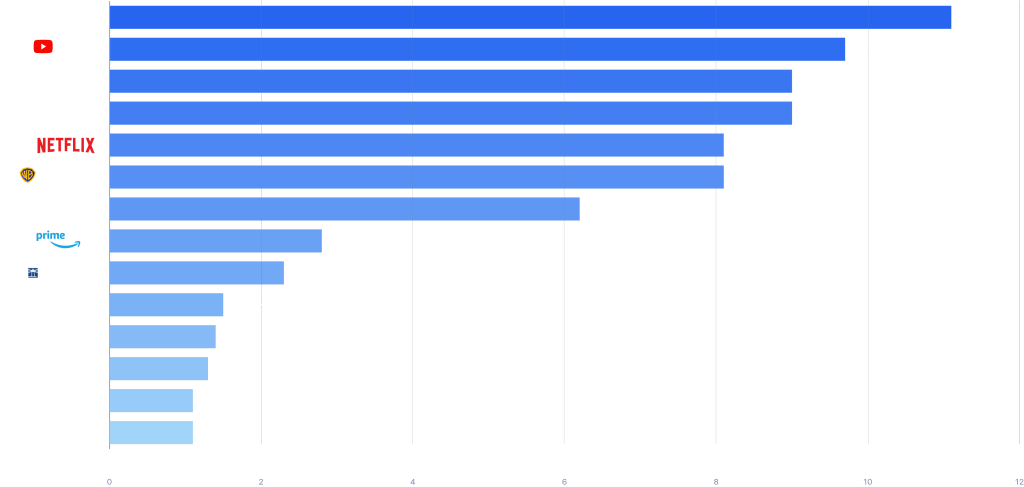

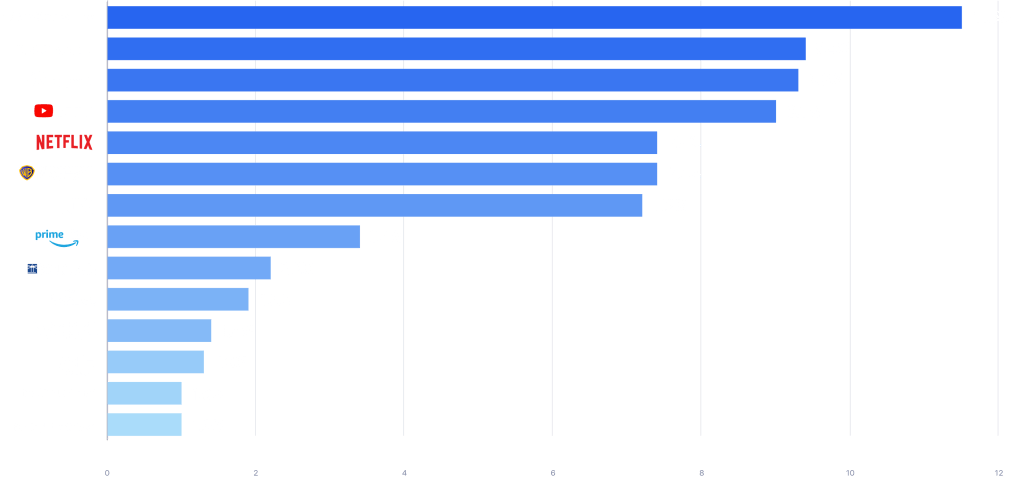

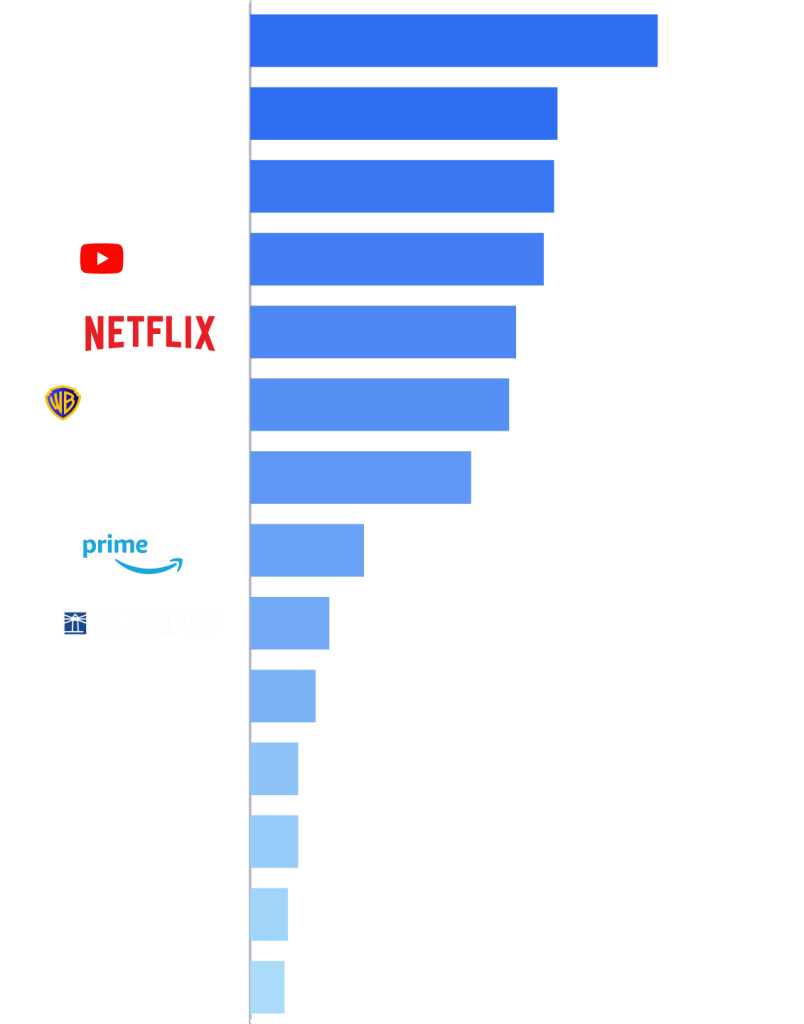

NEW YORK – July 23, 2024 – Netflix exhibited the largest monthly growth in the June 2024 Media Distributor Gauge report, Nielsen’s cross-platform view of total TV consumption aggregated by media company. With usage up 11.8% compared with May, Netflix added almost a full point to its share of total TV usage and moved from the sixth ranking media company in May, to fourth in June, accounting for 8.4% of TV for the month.

As covered in Nielsen’s report of The Gauge, 40.3% of time spent watching TV in June was attributable to streaming. Pure-play streamers like Netflix and YouTube saw the most benefit from a big streaming month. Time spent watching YouTube on television was up 4.2% in June to push the streamer to nearly 10% of total TV usage, securing another month with the second largest share of TV among media distributors.

While eight of the 14 companies ranked in the Media Distributor Gauge exhibited usage increases this month, affiliate streaming platforms helped rebalance the viewing share for multi-platform distributors across the board. With 10.8% of June’s TV viewing time, Disney maintained the top spot among media distributors, driven by a 15% increase in Disney+ usage. Also Tubi, which notched 2.0% of TV in June and a 15% bump in usage, climbed the ranks among its fellow FOX affiliates and was the company’s second best performer behind FOX News Channel, helping FOX climb to 6.6% of TV (+0.2 pt.).

NBCU retained its spot as the third ranking media distributor in June with 8.5% of TV, despite a loss of half a share point. The Olympics will certainly put the spotlight on NBCU throughout July and August as their coverage of the biennial event has historically drawn large audiences to all of its platforms.

The lack of sports and drama content on broadcast networks was, however, beneficial to cable entrants A&E, AMC and Hallmark whose affiliates helped fill the gaps by riding increases in viewing across cable’s feature film and drama genres.

- A&E: 1.4% share of TV; up 11.1%, +0.2 pt.

- Hallmark: 1.2% share of TV; up 6.1%, +0.1 pt.

- AMC: 1.1% share of TV; up 7.7%, +0.1 pt.

The measurement interval for June 2024 was 05/27/24 through 06/30/24.

About The Gauge™

The Gauge™ is Nielsen’s monthly snapshot of total broadcast, cable and streaming consumption that occurs through a television screen, providing the industry with a holistic look at what audiences are watching. The Gauge was expanded in April 2024 to include The Media Distributor Gauge, which reflects total viewing by media distributor across these categories. Read more about The Gauge methodology and FAQs.

About Nielsen

Nielsen is a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviors across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their global audiences—now and into the future. Learn more at www.nielsen.com and connect with us on social media (X, LinkedIn, YouTube, Facebook and Instagram).

Press Contact

Lauren Pabst, Nielsen

[email protected]

The post Netflix Makes Biggest Jump in Nielsen’s June Media Distributor Gauge, Up Nearly 12% From May appeared first on Nielsen.

]]>The post Nielsen’s Gracenote Expects USA, China, Great Britain, France and Australia to Lead 2024 Paris Olympic Games Medal Table appeared first on Nielsen.

]]>Almost all Russian and Belarussian competitors have been absent from international competitions since February 2022. Any who take part in Paris 2024 without results in this period cannot be predicted accurately. However, there is limited participation of these athletes and we expect the Virtual Medal Table to be the usual accurate reflection of the National Olympic Committees’ potential Olympic performance based on the data that we have.

Snapshot

Gracenote’s VMT forecast projects the United States to win the most medals overall at Paris 2024 (112). If Team USA meets this expectation, it would mark the team’s eighth successive placement at the top of the final Summer Games medal table.

China is projected to finish second on total medals but could challenge the United States for first place on gold medals. The 86 medals currently forecast for China would be three fewer than the country’s total of 89 in Tokyo three years ago. The 34 gold medals forecast would be four down on China’s total of 38 three years ago.

Great Britain is also expected to produce a similar performance to the last Olympics with the Gracenote VMT forecasting one British medal fewer than Tokyo’s 64. Gold medals could be significantly down though as the British team is projected to win 17 golds in Paris.

Host nation France should sharply increase its overall medal haul in comparison to the 33 total medals won in Tokyo. The Virtual Medal Table puts France in third place on gold medals, behind the United States and China, and its final forecast total of 27 gold medals would be not far short of France’s total number of medals at the last Olympics, if it is achieved.

Australia is expected to be fifth on the total medal table. The 54 medals forecasted by the Gracenote Virtual Medal Table would be the country’s most for 24 years, since winning a record 58 when hosting Sydney 2000.

Russian and Belarussian athletes

With competitors from Russia and Belarus being banned from international competition in almost all Olympic sports since February 2022, it is not possible to assess potential performance accurately for those participating as Individual Neutral Athletes at Paris 2024 unless they have been competing more or less normally like, for example, the tennis players from the two countries. However, it appears that the number of competitors from these countries is severely limited in Paris and the Gracenote Virtual Medal Table is therefore representing the current situation accurately given the data which we have.

The top-five medal winning countries

United States

(Paris 2024 projection: 112 medals, Tokyo 2020: 113)

The U.S. is expected to once again top the Summer Games Virtual Medal Table in Paris. The current Gracenote projection of 112 medals is similar to the total claimed by Team USA in 2021. The United States team has medals projected in 28 different sports in the Virtual Medal Table, one sport fewer than the country’s own Olympic record of 29 which was set in Tokyo. Athletics and swimming are still the key to success though with just under half of US medals projected to be won in those two sports.

China

(Paris 2024: 86, Tokyo 2020: 89)

At the Tokyo Olympics, China recovered from its total of 70 medals at the Rio Olympics, its lowest since 2004. Final Gracenote projections for Paris 2024 suggest that China will produce a similar performance to three years ago. Diving, shooting, swimming, table tennis, artistic gymnastics and badminton are China’s key medal-winning sports but 20 different sports have a top-three Chinese competitor according to the VMT. China’s projected gold medal total of 34 means that it may be a threat to the United States’ position as the winner of most golds in Paris.

Great Britain

(Paris 2024: 63, Tokyo 2020: 64)

The final Gracenote Virtual Medal Table for Paris 2024 suggests that Great Britain can sustain its winning performance of 60 or more medals for a fourth successive Olympic Summer Games. British success over the past three Summer Olympics has been built on having medal winners in at least 20 sports. Gracenote’s final VMT forecast has British medal winners in 21 different sports, suggesting that this trend is set to continue. Prior to the 2012 Olympic Games, Great Britain had not won medals in at least 20 sports for over 100 years, since hosting in 1908.

France

(Paris 2024: 60, Tokyo 2020: 33)

Gracenote’s final forecast projects that host nation France will increase its medal total significantly, nearly tripling its number of gold medals in comparison to the Tokyo Olympics. Summer Olympic success for France has been achieved in 15 to 19 different sports at each Olympics this century but medals are projected in 28 different sports in Paris. This would be a new French record. At the Paris 2024 Games, France is expected to have its best Olympic Games for 124 years, since winning 115 medals when hosting in 1900.

Australia

(Paris 2024: 54 medals, Tokyo 2020: 46)

After the disappointing Olympics of 2012 and 2016, Australia will again improve in Paris. Gracenote expects Australia to win over 40 medals for the sixth time in the last eight Olympics and more than 50 for the first time for 24 years. If Australia wins 54 medals as forecast, it will be the country’s best Olympic performance since hosting Sydney 2000. Achieving this will depend to a great extent on the success of the swimming team.

Virtual Medal Table 1-10

| NOC | Country | Gold | Silver | Bronze | Total |

|---|---|---|---|---|---|

| United States | 39 | 32 | 41 | 112 | |

| China | 34 | 27 | 25 | 86 | |

| Great Britain | 17 | 20 | 26 | 63 | |

| France | 27 | 21 | 12 | 60 | |

| Australia | 15 | 23 | 16 | 54 | |

| Japan | 13 | 13 | 21 | 47 | |

| Italy | 11 | 19 | 16 | 46 | |

| Germany | 11 | 12 | 12 | 35 | |

| Netherlands | 16 | 10 | 8 | 34 | |

| Republic of Korea | 9 | 4 | 13 | 26 |

Countries Ranked 6 to 10 on the Virtual Medal Table

Japan

(Paris 2024: 47, Tokyo 2020: 58)

After its record-breaking Olympics in Tokyo, Japan is expected to fall short of that performance in Paris. Gracenote’s final Virtual Medal Table has the Japanese team winning 11 fewer medals than three years ago. The number of gold medals likely to be won by Japan is expected to be more than halved, from 27 to 13. Medals are forecast in 17 different sports, well short of Japan’s record of 21 from Tokyo 2020. However, 47 medals would represent Japan’s second best Summer Games performance, after Tokyo 2020.

Italy

(Paris 2024 projection: 46, Tokyo 2020: 40)

Italy had its best ever Olympics in Tokyo but Gracenote’s final Virtual Medal Table projects an even better performance at Paris 2024. Buoyed by a potential best ever performance in the pool, Italy is forecast to win a record 46 medals across an all-time best 21 different sports, beating its record of 40 medals across 19 sports in Tokyo.

Germany

(Paris 2024: 35, Tokyo 2020: 37)

Germany’s medal total has declined at six of the seven Summer Olympics since reunification, with only London 2012 providing respite. Paris 2024 may continue that trend with Gracenote’s final Virtual Medal Table projecting 35 medals for Germany, two fewer than in Tokyo. The German team is forecast to win medals in 18 different sports, the joint second lowest since reunification, after London 2012. Germany no longer dominates any particular sport and no more than three medals for the German team are forecast by the VMT in any single sport.

Netherlands

(Paris 2024: 34, Tokyo 2020: 36)

Three years after its best Summer Olympics in Tokyo, the Dutch team is forecast to produce a similar performance in Paris. Gracenote’s final forecast has the Dutch team breaking the country’s gold medal record of 12, set at the Sydney 2000 Olympics but just falling short of the total medal record of 36 from the same Games. At four of the last six Olympic Games, the Netherlands has won medals in 11 to 13 sports. The 2024 Summer Games look like being a similar story with Gracenote forecasting medals in 12 different sports. However, success this year will primarily depend on three sports – rowing, cycling – track and athletics – which, between them, are expected to deliver half of the medals for the Netherlands.

Republic of Korea

(Paris 2024: 26, Tokyo 2020: 20)

Tokyo 2020 was a disappointing Olympics for the Republic of Korea. The 20 medals including six golds were both the lowest totals for the country since it won 19 and six respectively at the Los Angeles Olympics of 1984. The prospects for Paris 2024 look better with Korean competitors forecast to win 26 medals, including nine golds, across 11 different sports. This would be Korea’s best Olympic medal winning performance since 2012 and it would put Korea back into the top-10 medal winning nations.

Virtual Medal Table 11-20

| NOC | Country | Gold | Silver | Bronze | Total |

|---|---|---|---|---|---|

| Canada | 7 | 9 | 5 | 21 | |

| Hungary | 7 | 6 | 7 | 20 | |

| Brazil | 8 | 4 | 6 | 18 | |

| Spain | 5 | 5 | 8 | 18 | |

| Poland | 3 | 7 | 7 | 17 | |

| Denmark | 5 | 5 | 4 | 14 | |

| Turkiye | 4 | 5 | 5 | 14 | |

| New Zealand | 4 | 4 | 6 | 14 | |

| Ukraine | 2 | 4 | 7 | 13 | |

| Ethiopia | 6 | 3 | 3 | 12 |

Virtual Medal Table 21-30

| NOC | Country | Gold | Silver | Bronze | Total |

|---|---|---|---|---|---|

| Kenya | 5 | 4 | 3 | 12 | |

| Sweden | 4 | 4 | 4 | 12 | |

| Belgium | 4 | 2 | 6 | 12 | |

| Georgia | 3 | 4 | 5 | 12 | |

| Uzbekistan | 3 | 2 | 7 | 12 | |

| Switzerland | 0 | 6 | 6 | 12 | |

| Iran | 4 | 2 | 5 | 11 | |

| Ireland | 2 | 3 | 5 | 10 | |

| Kazakhstan | 2 | 3 | 5 | 10 | |

| Jamaica | 1 | 5 | 4 | 10 |

About Gracenote Virtual Medal Table

The Gracenote Virtual Medal Table is a statistical model based on individual and team results in previous Olympics Games, World Championships and World Cups to forecast the most likely gold, silver and bronze medal winners by country. This information is presented in simple to understand projections and seamless data feeds that enable broadcasters, media publishers and pay TV operators to deliver unique Olympic-focused stories across Web, mobile and broadcast properties. https://www.nielsen.com/news-center/2024/virtual-medal-table-forecast/

About Gracenote

Gracenote is the content solutions business unit of Nielsen providing entertainment metadata, content IDs and related offerings to the world’s leading creators, distributors and platforms. Gracenote technology enables advanced content navigation and discovery capabilities ensuring consumers can easily connect to the music, TV shows, movies and sports they love while delivering powerful content analytics making complex business decisions simpler.

About Nielsen

Nielsen shapes the world’s media and content as a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviors across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their audiences—now and into the future. Nielsen operates around the world in more than 55 countries. Learn more at www.nielsen.com and connect with us on social media (Twitter, LinkedIn, Facebook and Instagram).

The post Nielsen’s Gracenote Expects USA, China, Great Britain, France and Australia to Lead 2024 Paris Olympic Games Medal Table appeared first on Nielsen.

]]>